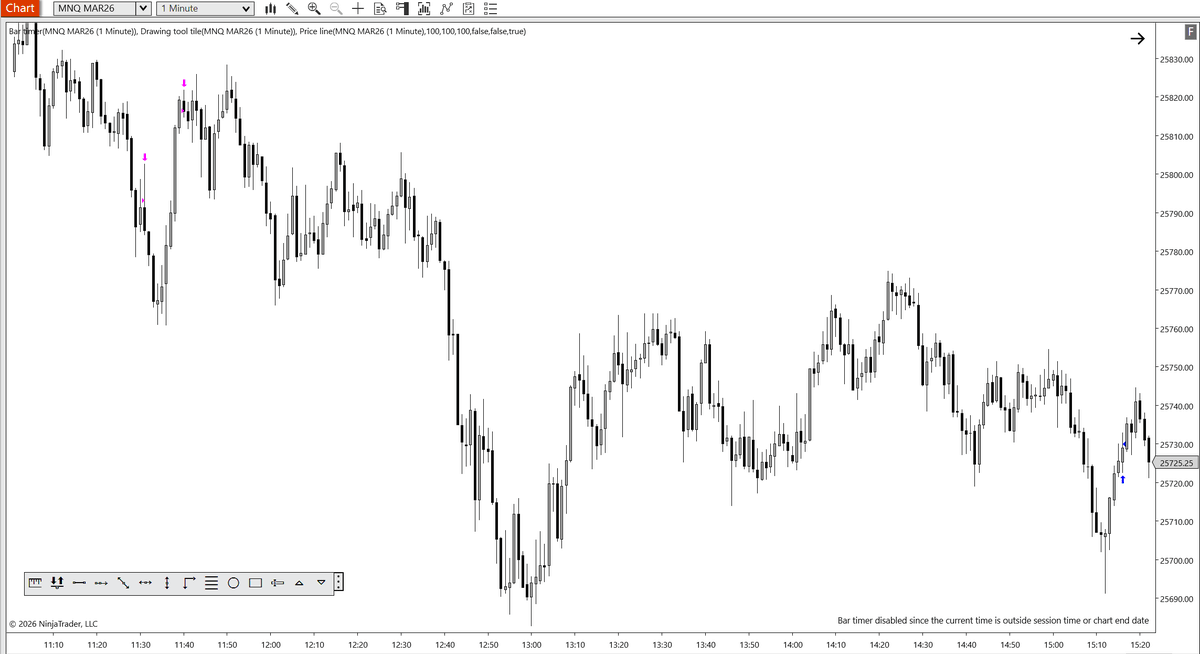

📉 NY lunch macro scalp | +2.46R long

I was bearish since pre-market. HTF context showed a strong bearish bias, but I didn’t find a setup that made me feel confident earlier in the session, so I stayed patient and did nothing.

The only trade I took was during the 11:50–12:10 NY https://t.co/UU9HrWSYQm

I was bearish since pre-market. HTF context showed a strong bearish bias, but I didn’t find a setup that made me feel confident earlier in the session, so I stayed patient and did nothing.

The only trade I took was during the 11:50–12:10 NY https://t.co/UU9HrWSYQm

3

0

11

3.5K

0

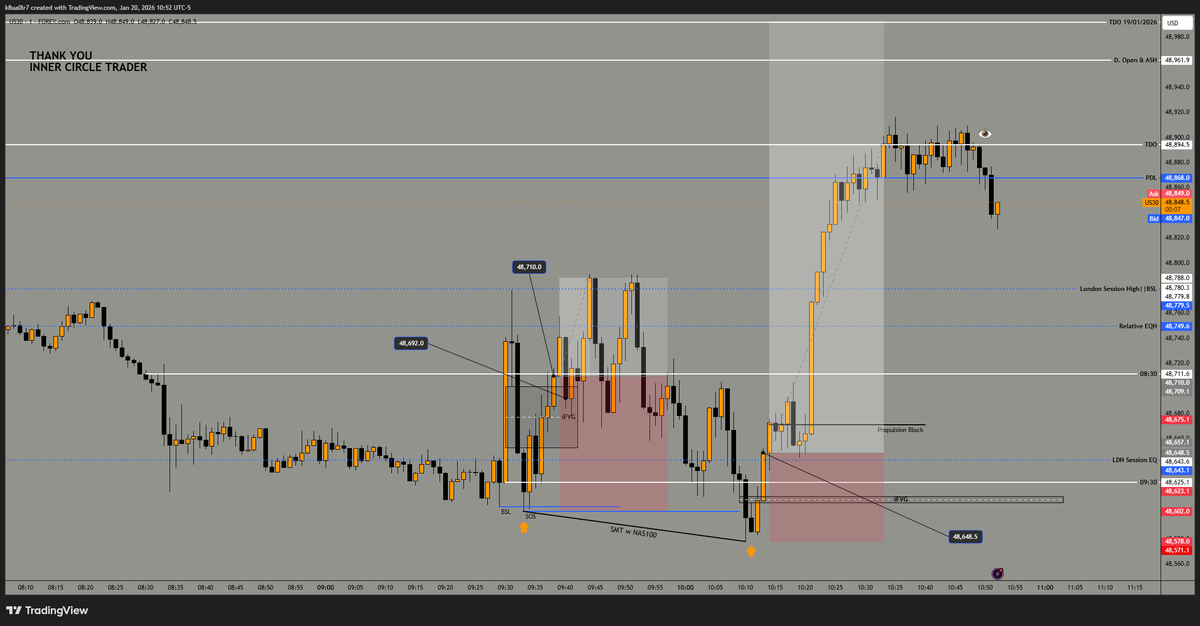

📉 First trade of the week | NY open short +3.32R

✔ HTF bias was neutral, leaning bearish after PDH (Premarket) was taken, so I expected a retracement toward EQ of the 1H dealing range.

✔ At the 9:30 NY open, price sold off aggressively, disrespecting bullish PDAs along the https://t.co/UdQieO9eX1

✔ HTF bias was neutral, leaning bearish after PDH (Premarket) was taken, so I expected a retracement toward EQ of the 1H dealing range.

✔ At the 9:30 NY open, price sold off aggressively, disrespecting bullish PDAs along the https://t.co/UdQieO9eX1

3

0

8

2.8K

0

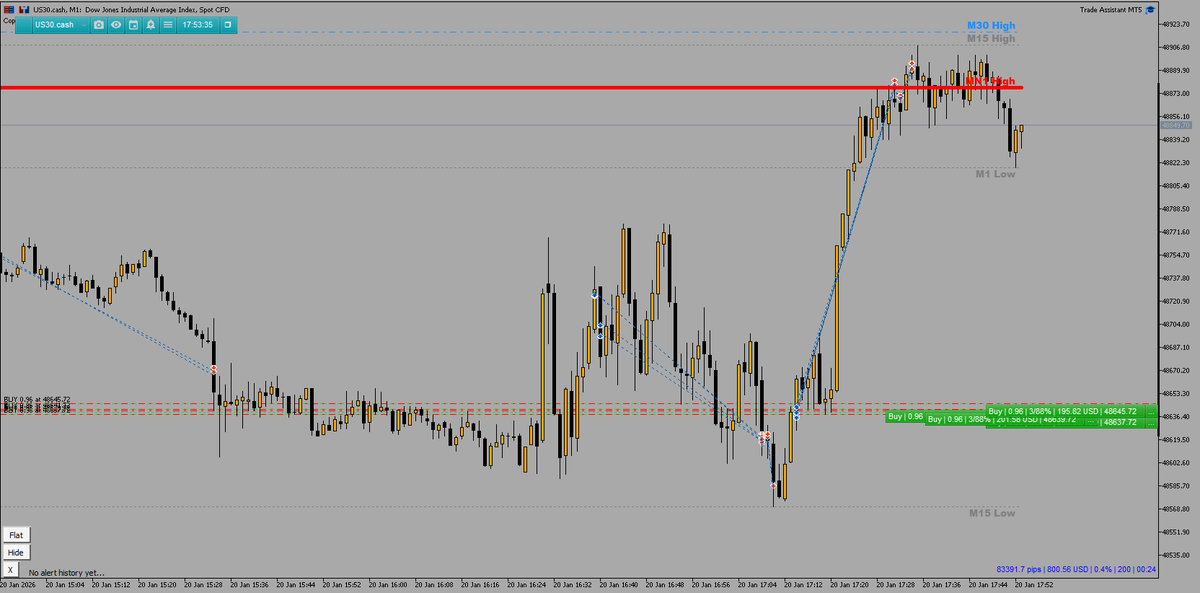

🚨 RR 1:23.

Yes, you read that right.

A WILD move, caught purely by the algorithm.

📊 IPDA 3 Days Data Range — IN PLAY

No indicators.

No guessing.

Just institutional logic.

All of this thanks to @MonsterLab3 and to my mentor @TraderDext3r.

When you’re taught the RIGHT knowledge https://t.co/oMdm0XgBbM

Yes, you read that right.

A WILD move, caught purely by the algorithm.

📊 IPDA 3 Days Data Range — IN PLAY

No indicators.

No guessing.

Just institutional logic.

All of this thanks to @MonsterLab3 and to my mentor @TraderDext3r.

When you’re taught the RIGHT knowledge https://t.co/oMdm0XgBbM

1

0

6

1.3K

1

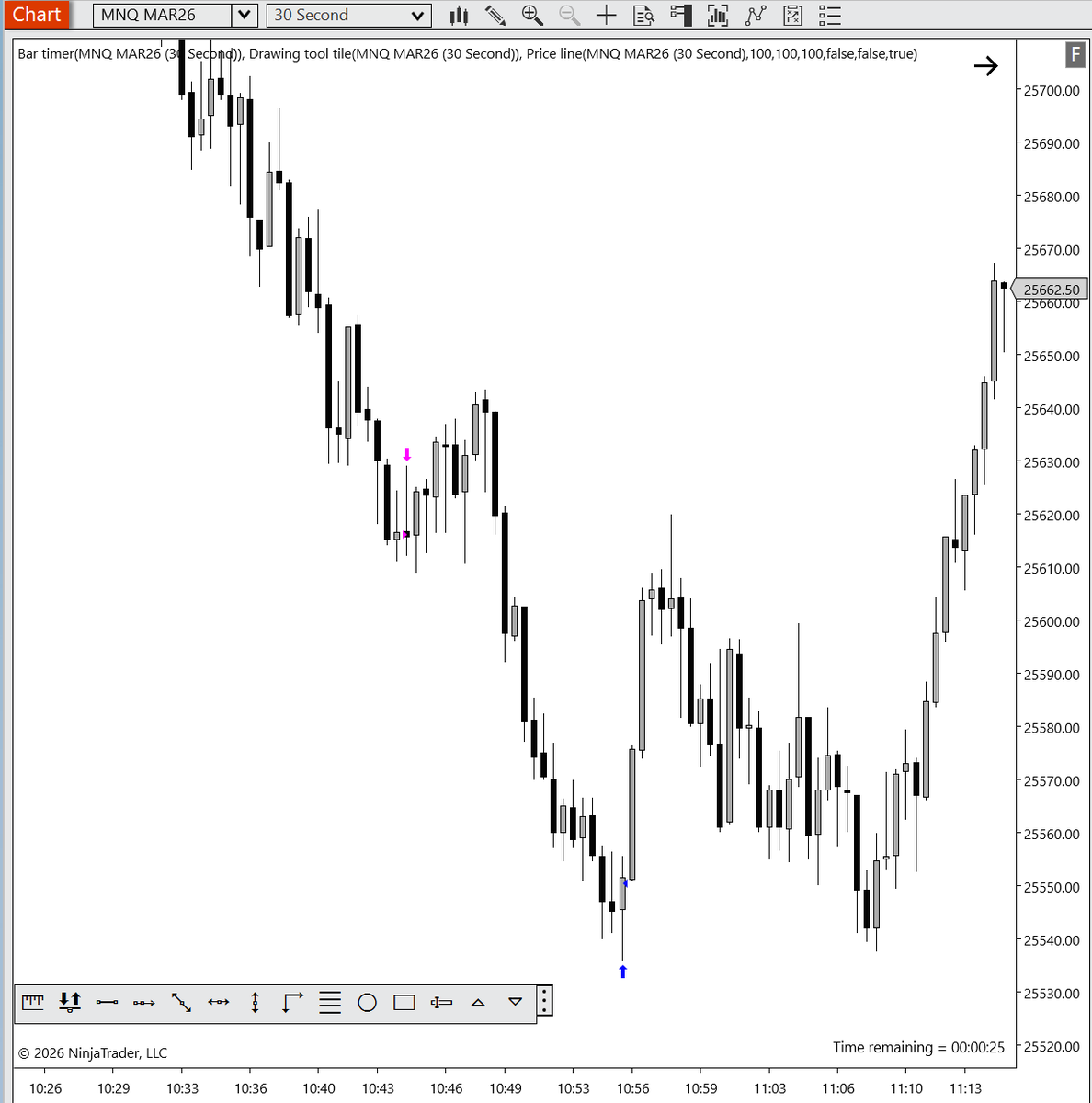

📉 NY late-morning short: +1.6R

✔ HTF short-term bearish

✔ Morning sell-off (distribution) still in play

✔ Expected more downside into the 10:50–11:10 AM macro window

Execution

• Entry on a retest of volume imbalance with immediate rejection

• SL at the trade invalidation https://t.co/OciNTxnkGp

✔ HTF short-term bearish

✔ Morning sell-off (distribution) still in play

✔ Expected more downside into the 10:50–11:10 AM macro window

Execution

• Entry on a retest of volume imbalance with immediate rejection

• SL at the trade invalidation https://t.co/OciNTxnkGp

0

0

12

3.3K

0

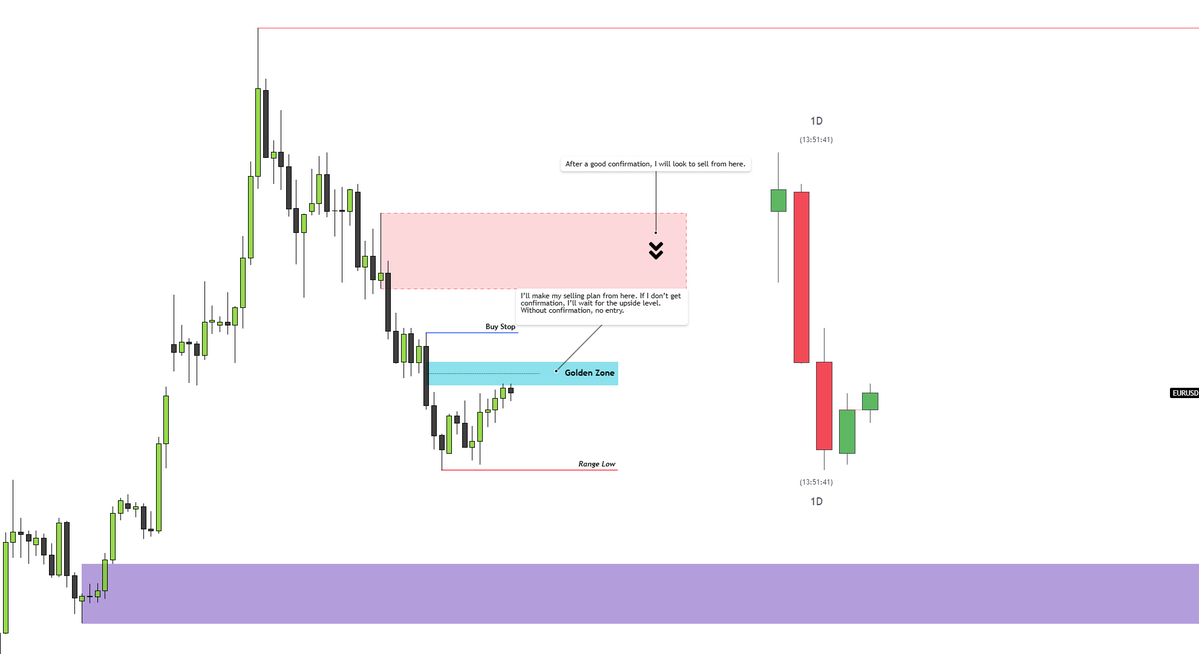

📉 FOMC trade recap: +3.32R

✔ HTF context was bullish, but short term bearish

✔ I was waiting for price to trade into premium to look for shorts

• First entry above EQ (premium) into a 1H SIBI

Closed early at BE because PA wasn’t convincing

• Second entry at the same level https://t.co/I8hkmB1Leq

✔ HTF context was bullish, but short term bearish

✔ I was waiting for price to trade into premium to look for shorts

• First entry above EQ (premium) into a 1H SIBI

Closed early at BE because PA wasn’t convincing

• Second entry at the same level https://t.co/I8hkmB1Leq

0

0

9

1.6K

2

📚 Great study day for me today 😊

I didn’t take any trades, but I did spot a very clean opportunity in the PM session.

Today’s price action played out exactly as described in Episode 9 of the 2022 ICT Mentorship.

ICT explains that after a large overnight run, the NY AM session https://t.co/WUaQPNSJnL

I didn’t take any trades, but I did spot a very clean opportunity in the PM session.

Today’s price action played out exactly as described in Episode 9 of the 2022 ICT Mentorship.

ICT explains that after a large overnight run, the NY AM session https://t.co/WUaQPNSJnL

0

2

19

2.8K

0

📈 First trade of the week: +4.79R long (PM session)

Over the past days, I took the time to revisit the 2022 ICT Mentorship, clean up a few things I had forgotten, and refocus on execution. Today, that patience paid off.

This morning I had a bullish bias, but price didn’t offer https://t.co/REO7JrIyry

Over the past days, I took the time to revisit the 2022 ICT Mentorship, clean up a few things I had forgotten, and refocus on execution. Today, that patience paid off.

This morning I had a bullish bias, but price didn’t offer https://t.co/REO7JrIyry

3

1

16

3.0K

2

📈 NY AM session recap: 3 wins, 1 loss

• HTF context bearish

• 9:30 open below PDL → bearish continuation expected

• 4H BISI inversion confirmed bearish bias

• SSL resting below

• After 9:30 open, candle bodies respected the lower quadrant of the opening range gap

• All https://t.co/j6EI2d6kTB

• HTF context bearish

• 9:30 open below PDL → bearish continuation expected

• 4H BISI inversion confirmed bearish bias

• SSL resting below

• After 9:30 open, candle bodies respected the lower quadrant of the opening range gap

• All https://t.co/j6EI2d6kTB

3

0

14

683

2

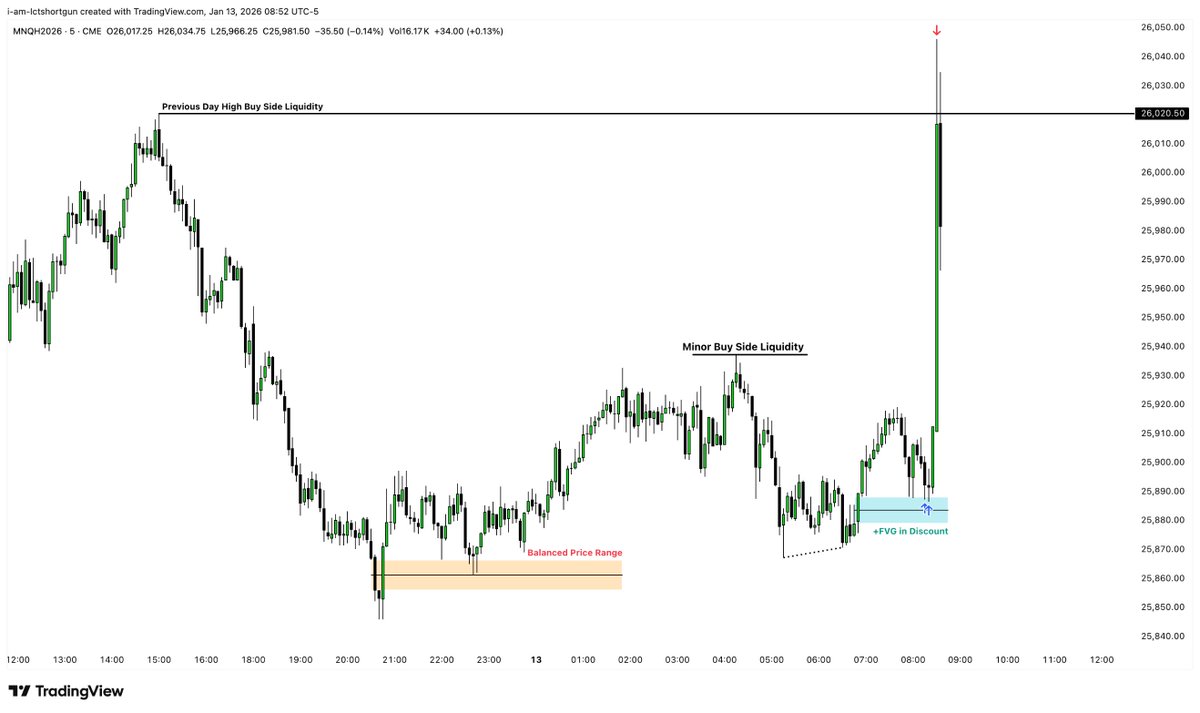

📈 CPI day’s trade: missed the short at the open and waited for longs. +5.88R win

• HTF PDAs respected and smooth levels above, bullish bias

• PDH taken before the open, expected a retracement down to take some SSL before continuing higher

• Asia low taken, price reacted https://t.co/73ApDNWUgu

• HTF PDAs respected and smooth levels above, bullish bias

• PDH taken before the open, expected a retracement down to take some SSL before continuing higher

• Asia low taken, price reacted https://t.co/73ApDNWUgu

0

0

8

705

0

13.1K

Total Members

2

24h Growth

19

7d Growth

Date Members Change

Feb 10, 2026 13.1K -2

Feb 9, 2026 13.1K -5

Feb 8, 2026 13.1K -5

Feb 7, 2026 13.1K -2

Feb 6, 2026 13.1K -1

Feb 5, 2026 13.1K -4

Feb 4, 2026 13.1K -2

Feb 3, 2026 13.1K -2

Feb 2, 2026 13.1K -1

Feb 1, 2026 13.1K +0

Jan 31, 2026 13.1K -4

Jan 30, 2026 13.2K +6

Jan 29, 2026 13.1K -3

Jan 28, 2026 13.2K —

No reviews yet

Be the first to share your experience!

Share Your Experience

Sign in with X to leave a review and help others discover great communities

Login with XLoading...

Folks who trade or are learning ICT (Inner Circle Trading). Recommended tool https://ictindex.io to help you study.

Community Rules

No signal groups or provide signals

HARD rule. Do not do it

Do NOT promote any telegram or discord groups.

Also do not post a follow-up thread with your group link.

Don’t post basic educational material.

Do not promote any giveaways

No self promotion of services unless you ask moderator first

Be kind and respectful.

Keep Tweets on topic.

Got a question? Use the AI tool https://ictindex.io