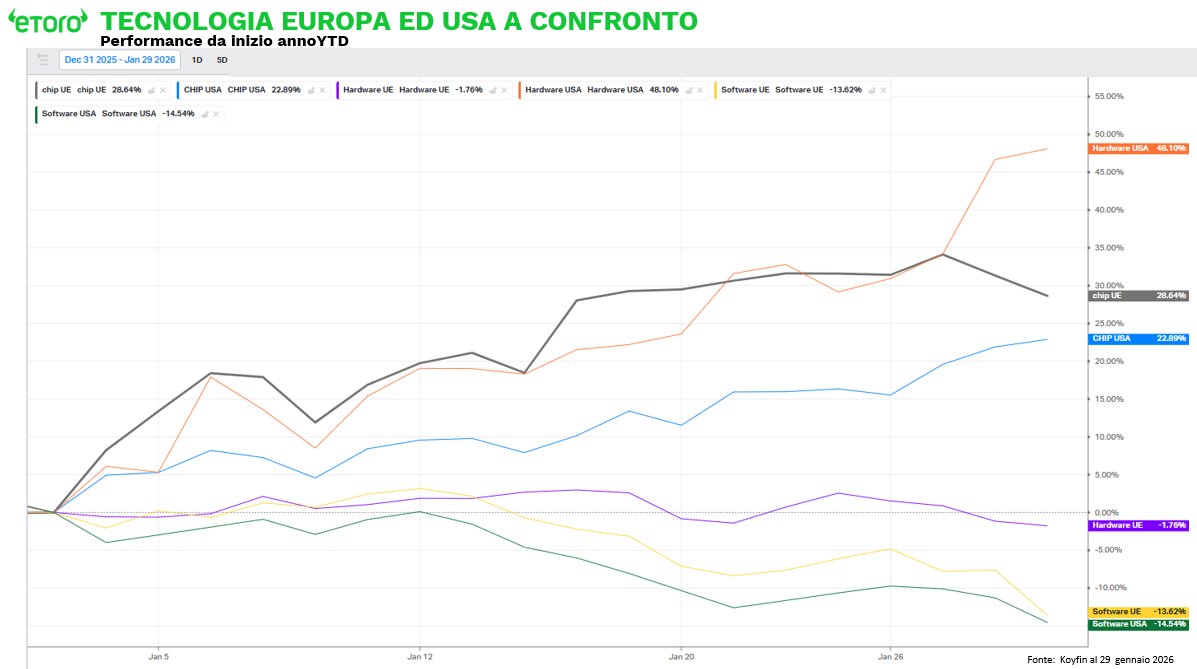

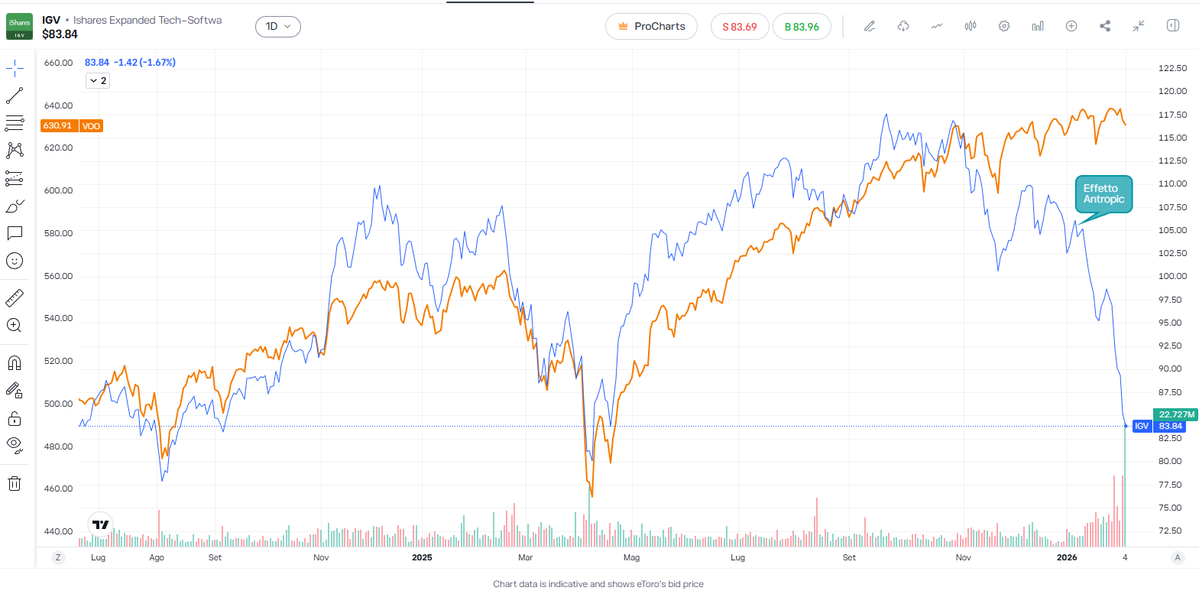

🚨 From Jobpocalypse to SaaSpocalypse. The narrative has shifted. For 3 years, AI was a "margin booster" (productivity). Now, AI is a "structural competitor" (disintermediation). The market isn't crashing ($SPX <2% from highs), but Software is being repriced. Here is why. 🧵👇 https://t.co/ge9NIKvXBk

1

0

1

275

0

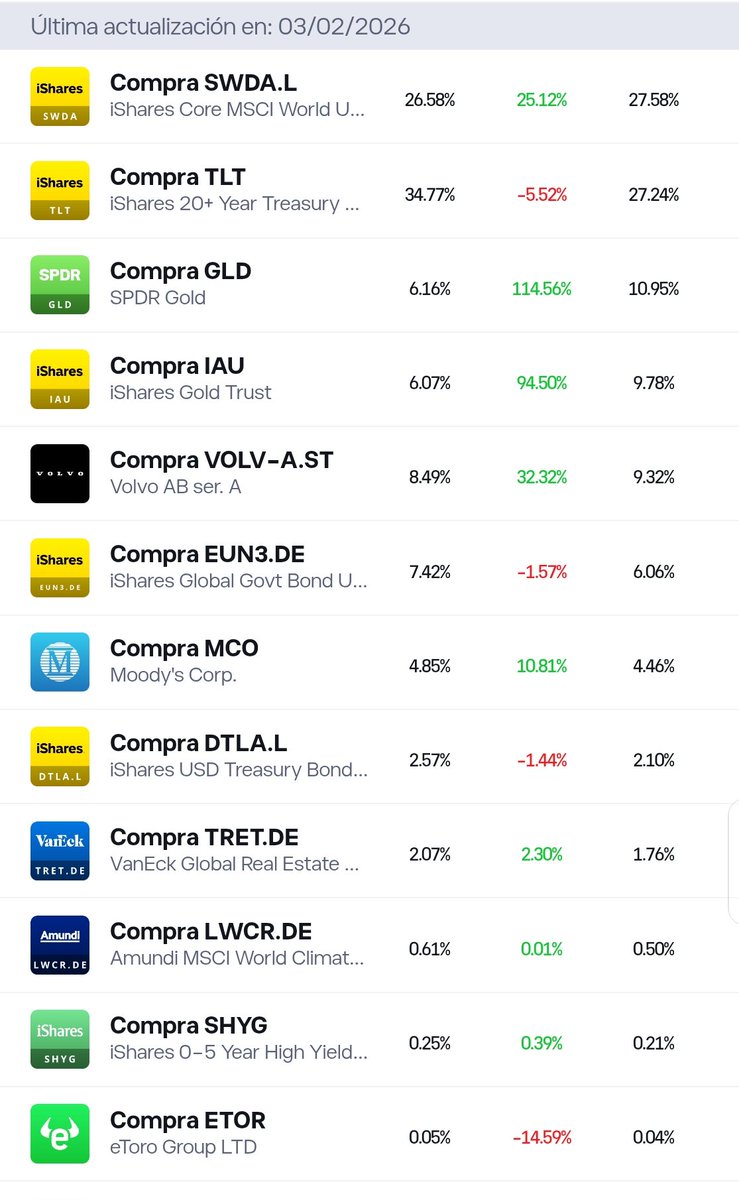

Hedging the hedge: an all-weather portfolio 🛡️

In my portfolio, for every 100 basis points in bonds, I hold 50 in gold. In today’s terms, that means roughly 40% in bonds and 20% in gold.

Let’s imagine an extremely unlikely, almost impossible scenario: the United States fully https://t.co/adEM3S0Bzr

In my portfolio, for every 100 basis points in bonds, I hold 50 in gold. In today’s terms, that means roughly 40% in bonds and 20% in gold.

Let’s imagine an extremely unlikely, almost impossible scenario: the United States fully https://t.co/adEM3S0Bzr

0

0

0

9

0

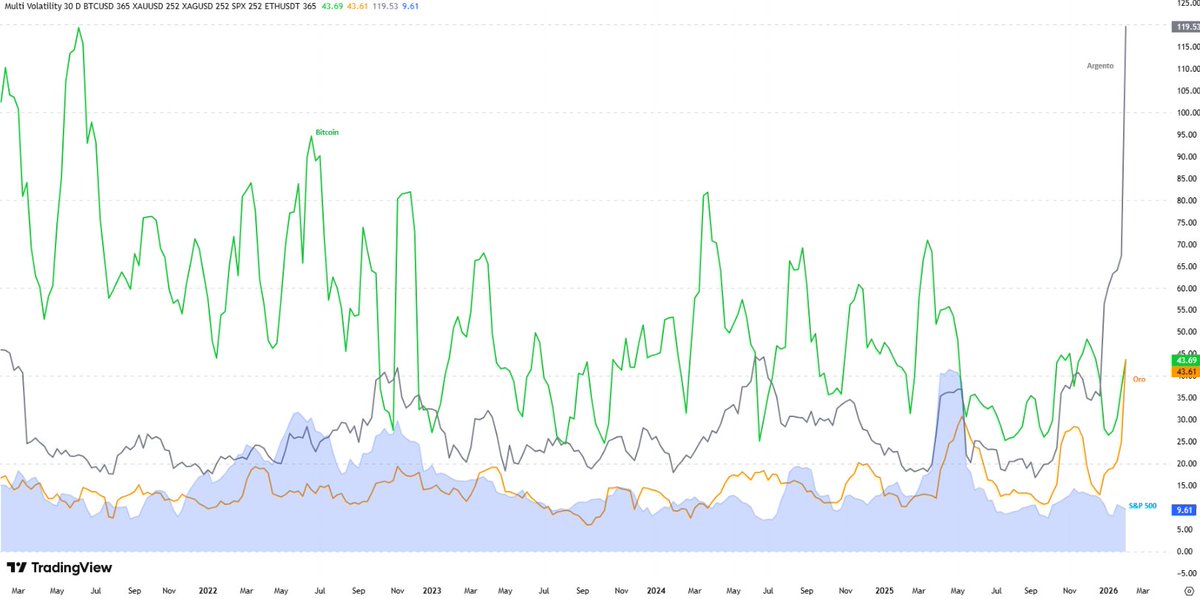

Math implies a regime change. 👇

Volatility Annualized (30D):

🟦S&P 500: 9.61

🟨 Gold: 43.61

🟩 Bitcoin: 43.69

⬜ Silver: 119.53

1. BTC & Gold are mathematically identical right now.

2. Silver is trading at 12x the volatility of the Stock Market.

3. The S&P 500 is repressing https://t.co/ggQ2su0yKX

Volatility Annualized (30D):

🟦S&P 500: 9.61

🟨 Gold: 43.61

🟩 Bitcoin: 43.69

⬜ Silver: 119.53

1. BTC & Gold are mathematically identical right now.

2. Silver is trading at 12x the volatility of the Stock Market.

3. The S&P 500 is repressing https://t.co/ggQ2su0yKX

0

0

2

394

0

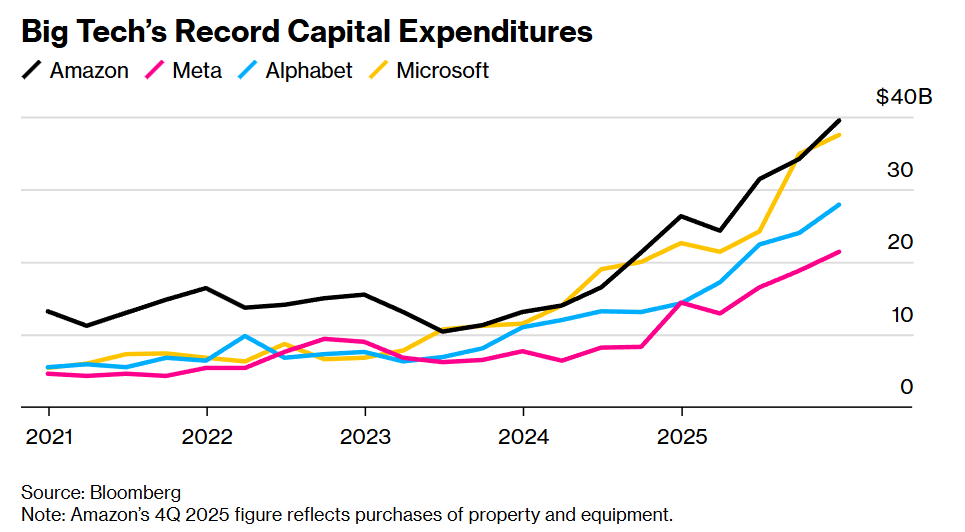

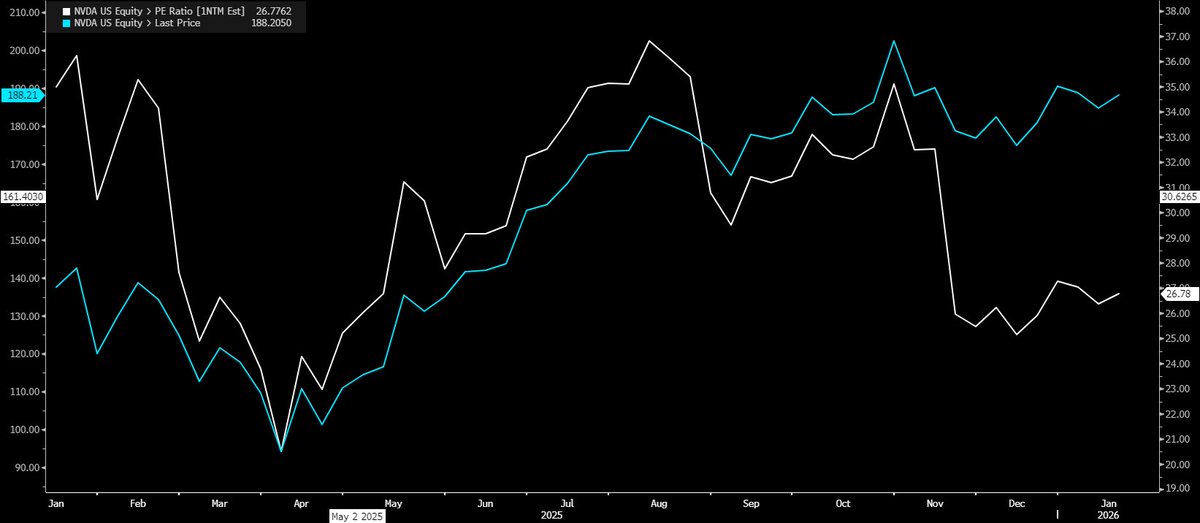

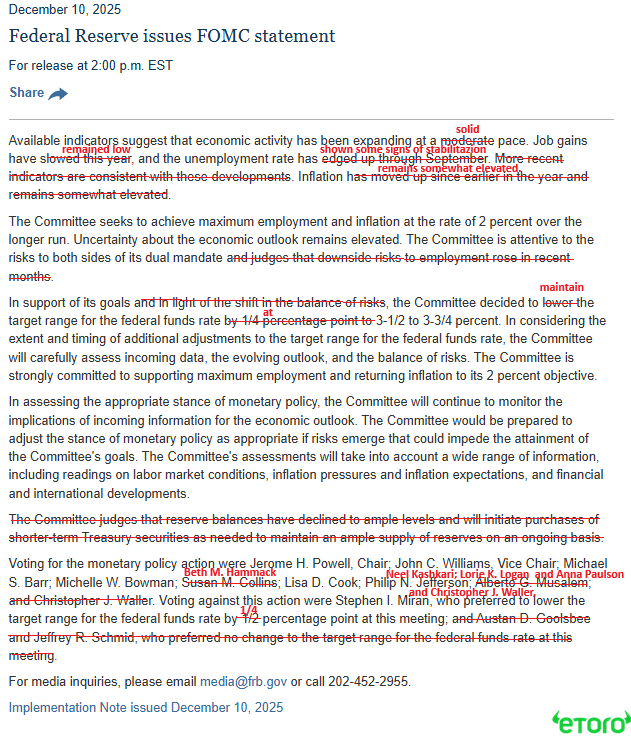

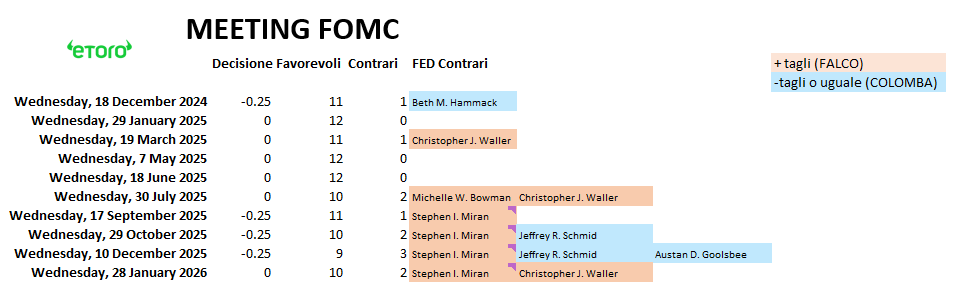

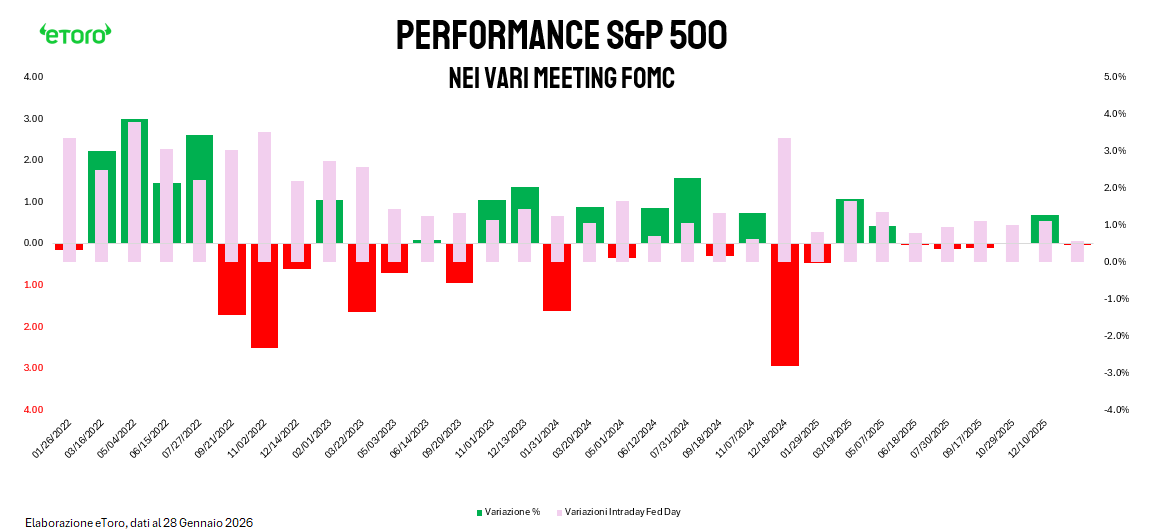

In few hours, the narrative shifted from "When will the Fed cut?" to "Is AI CapEx paying off?". A tale of a Dovish Pause and three massive earnings reports. Here is the breakdown of a defining day for the market. 🧵👇

The Fed 🦅➡️🕊️ The Dovish Pause Powell held rates steady https://t.co/J8Spy8ZVLt

The Fed 🦅➡️🕊️ The Dovish Pause Powell held rates steady https://t.co/J8Spy8ZVLt

0

0

1

161

0

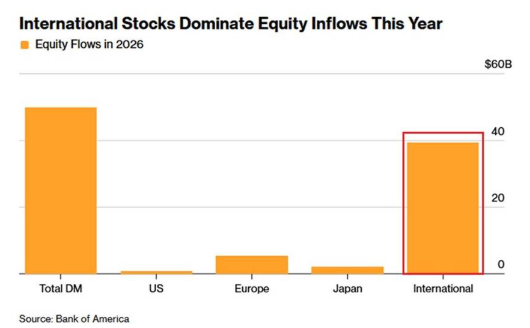

The Dollar is crashing (EUR/USD 1.20), but Credit Spreads are tight. The currency is acting as the system's "shock absorber" so assets don't have to reprice. While the US slows down, a massive rotation is happening elsewhere. Here is what the market is telling us. 🧵👇 https://t.co/TngyP46geu

1

0

1

498

0

European Gas (#TTF) is back near €40/MWh, up ~47% from recent lows. The market isn't pricing a supply shortage; it’s pricing a "margin crisis." Europe is entering the coldest part of winter with a thinner safety buffer and higher structural risks. Here is the breakdown 🧵👇 https://t.co/67HAE1wNWr

1

0

0

326

0

Something I see quite often (and it doesn’t make much sense):

People look at my portfolio, see the ETFs and stocks…

and then try to replicate it manually.

The problem is simple:

– Buying ETFs and stocks individually means you do pay commissions.

– It’s not automated: you have https://t.co/V3qCASZkF6

People look at my portfolio, see the ETFs and stocks…

and then try to replicate it manually.

The problem is simple:

– Buying ETFs and stocks individually means you do pay commissions.

– It’s not automated: you have https://t.co/V3qCASZkF6

0

0

0

16

0

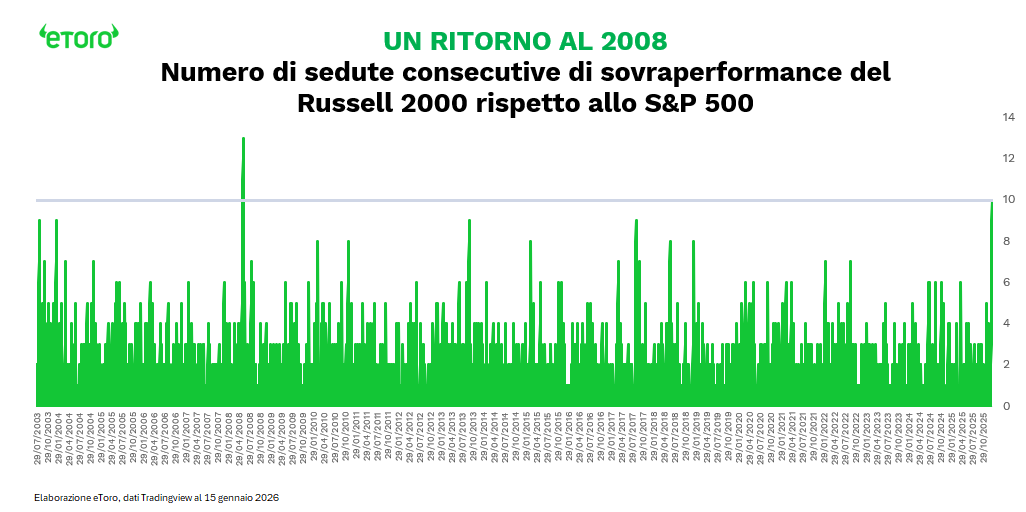

1/5 🚨 Historic Market Shift: Small Caps have outperformed the S&P 500 for 10 consecutive days. This hasn't happened since 2008. Liquidity is rotating from Big Tech to the real economy. The "Risk On" narrative is officially confirmed. 🐂🇺🇸

2/5 Macro data just wiped out recession https://t.co/22jBPi5DH7

2/5 Macro data just wiped out recession https://t.co/22jBPi5DH7

0

0

1

230

0

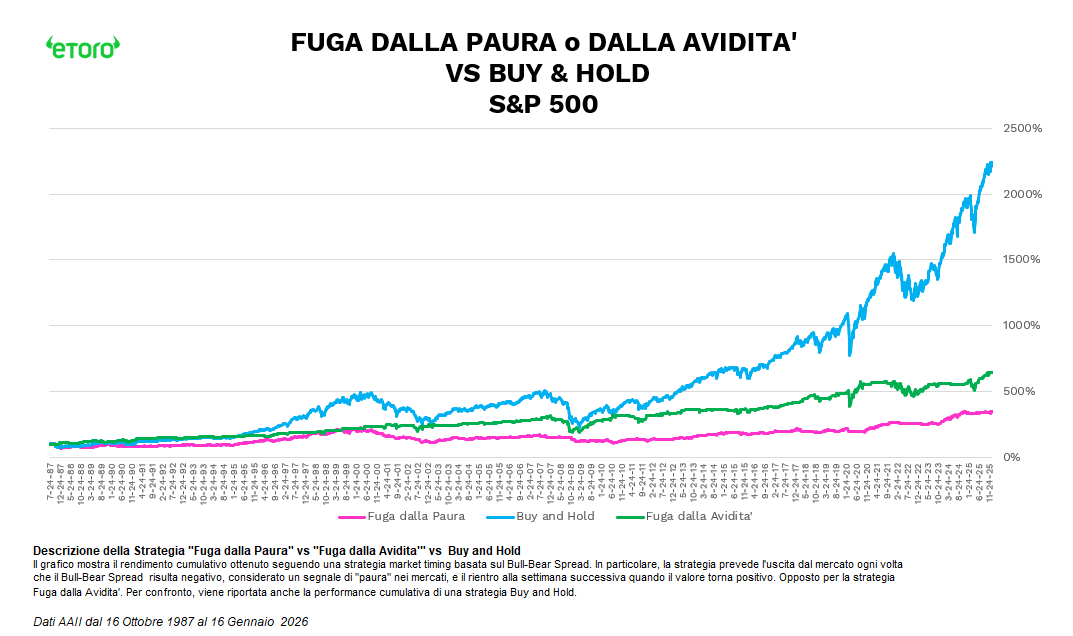

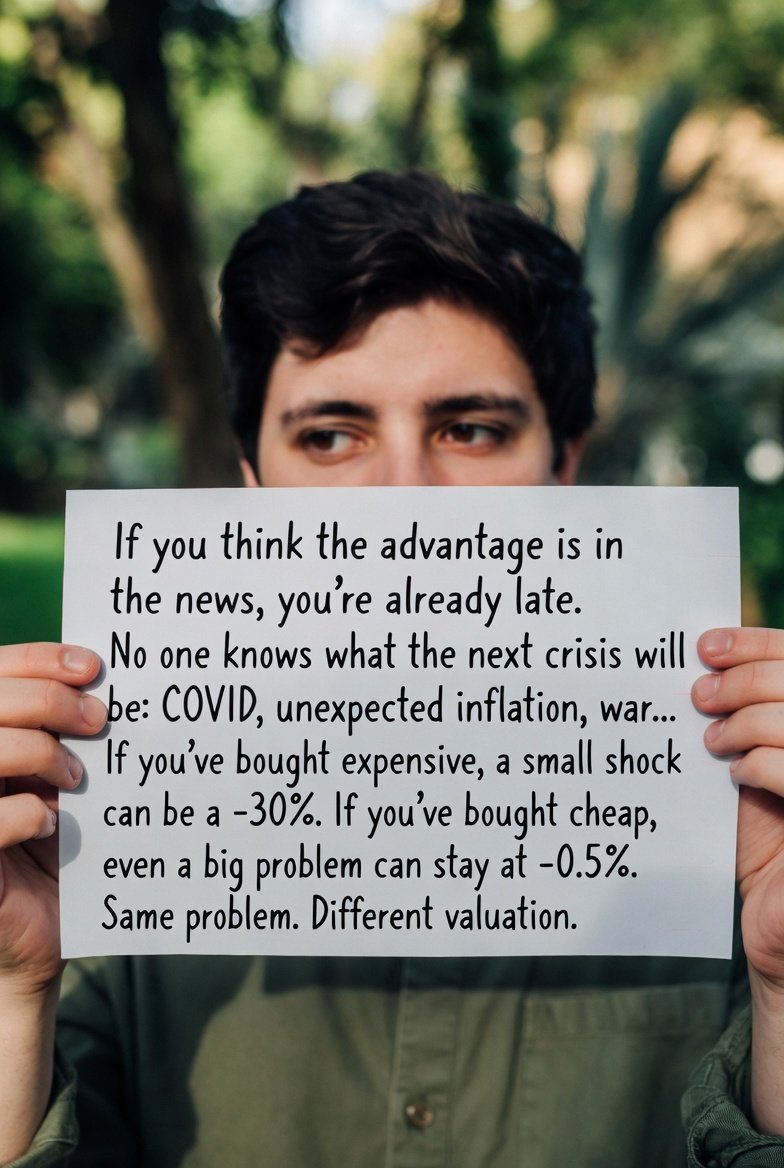

If you think the edge is in the news, you’re already late.

No one knows what the next crisis will be: COVID, unexpected inflation, war…

If you bought expensive, a small shock can cost you –30%.

If you bought cheap, even a big problem might only be –0.5%.

Same problem. https://t.co/C1wjrCVN3d

No one knows what the next crisis will be: COVID, unexpected inflation, war…

If you bought expensive, a small shock can cost you –30%.

If you bought cheap, even a big problem might only be –0.5%.

Same problem. https://t.co/C1wjrCVN3d

0

1

3

672

0

274

Total Members

+ 0

24h Growth

+ 0

7d Growth

Date Members Change

Feb 10, 2026 274 +0

Feb 9, 2026 274 +0

Feb 8, 2026 274 +0

Feb 7, 2026 274 +0

Feb 6, 2026 274 +0

Feb 5, 2026 274 +0

Feb 4, 2026 274 +0

Feb 3, 2026 274 +0

Feb 2, 2026 274 +0

Feb 1, 2026 274 +0

Jan 31, 2026 274 +0

Jan 30, 2026 274 +0

Jan 29, 2026 274 +0

Jan 28, 2026 274 —

No reviews yet

Be the first to share your experience!

Share Your Experience

Sign in with X to leave a review and help others discover great communities

Login with XLoading...

Connect with top investors and analysts to share insights, discuss market trends, and foster global financial learning. Not investment advice.

Community Rules

Be kind and respectful. Always.

We are here to share ideas, and support one another

Keep posts on topic.

This community focuses on discussions about finance, stock markets, and money-related topics

Explore and share.

Share your thoughts and ideas, and contribute meaningfully to the community.

This is not a Customer Service group

For any assistance please go to: https://www.etoro.com/customer-service/