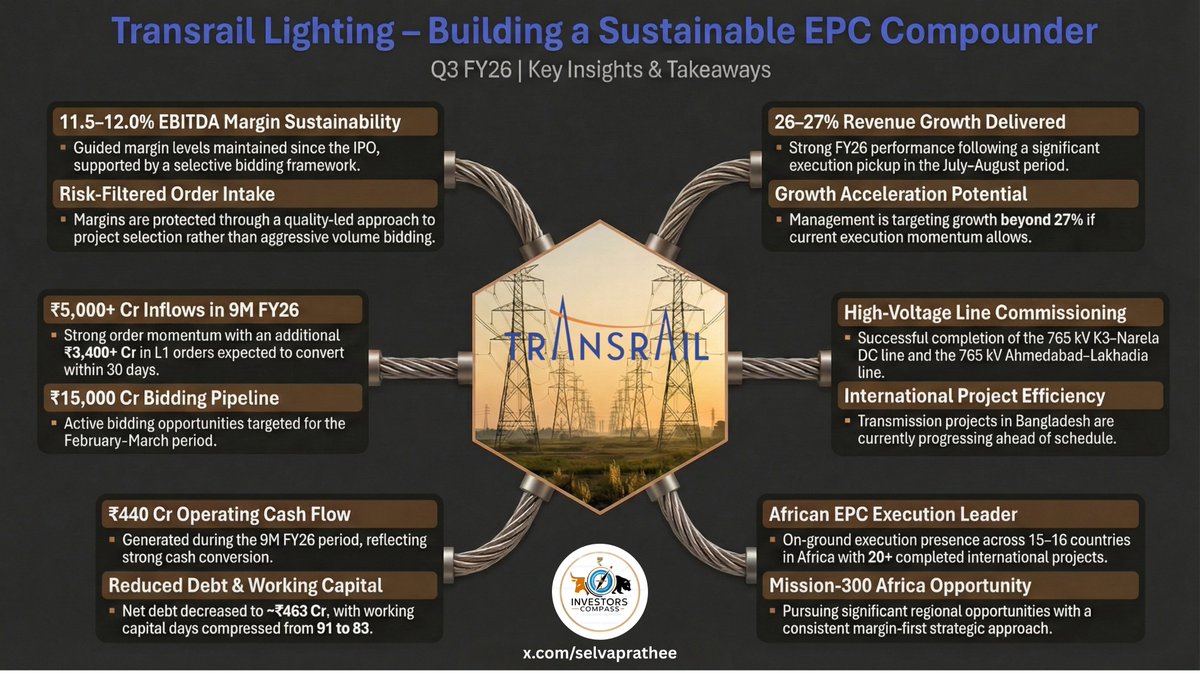

Q3 & 9M FY26 | Key Insights & Takeaways

1 | The Big Question Everyone Asked

Q: Is this Q3 surge real… or just a one-off?

Management’s answer (clear & repeated across platforms):

➡️ This https://t.co/BgGbgJhdY9

The company saw massive double-digit growth in both sales and profits compared to https://t.co/hqLQwj7sUK

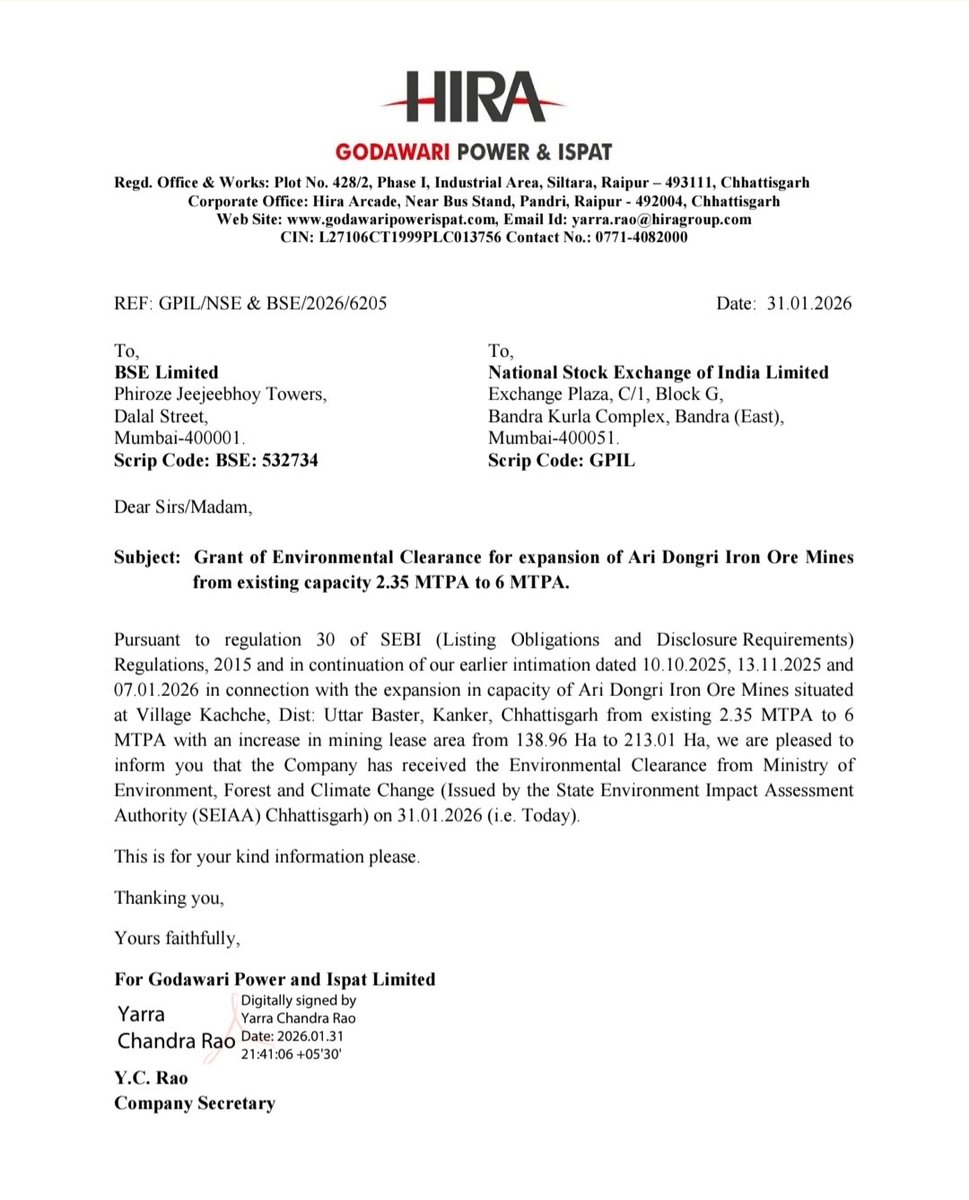

▪️ Environmental Clearance RECEIVED

▪️ Ari Dongri Iron Ore Mine expansion approved

What changed ?

▪️ Mining capacity approved from 2.35 MTPA ➝ 6.0 MTPA

▪️ https://t.co/7D1B40NgZE

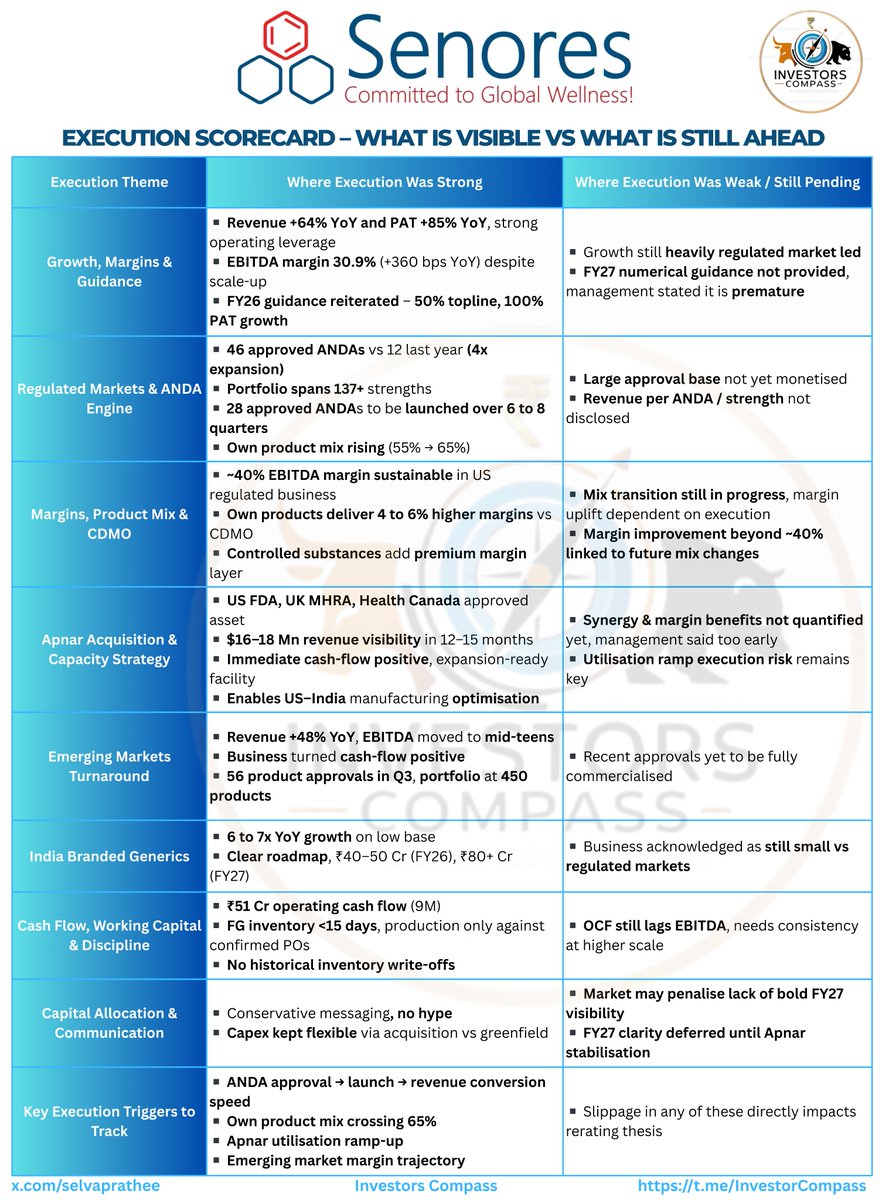

- Here’s a clean breakdown of what is already visible vs what management says is still pending

1️⃣ Growth & Profitability – ✅ Working

▪️ Revenue +64% YoY

▪️ PAT +85% YoY

▪️ EBITDA margin 30.9% (+360 https://t.co/FsGZaFR9pp

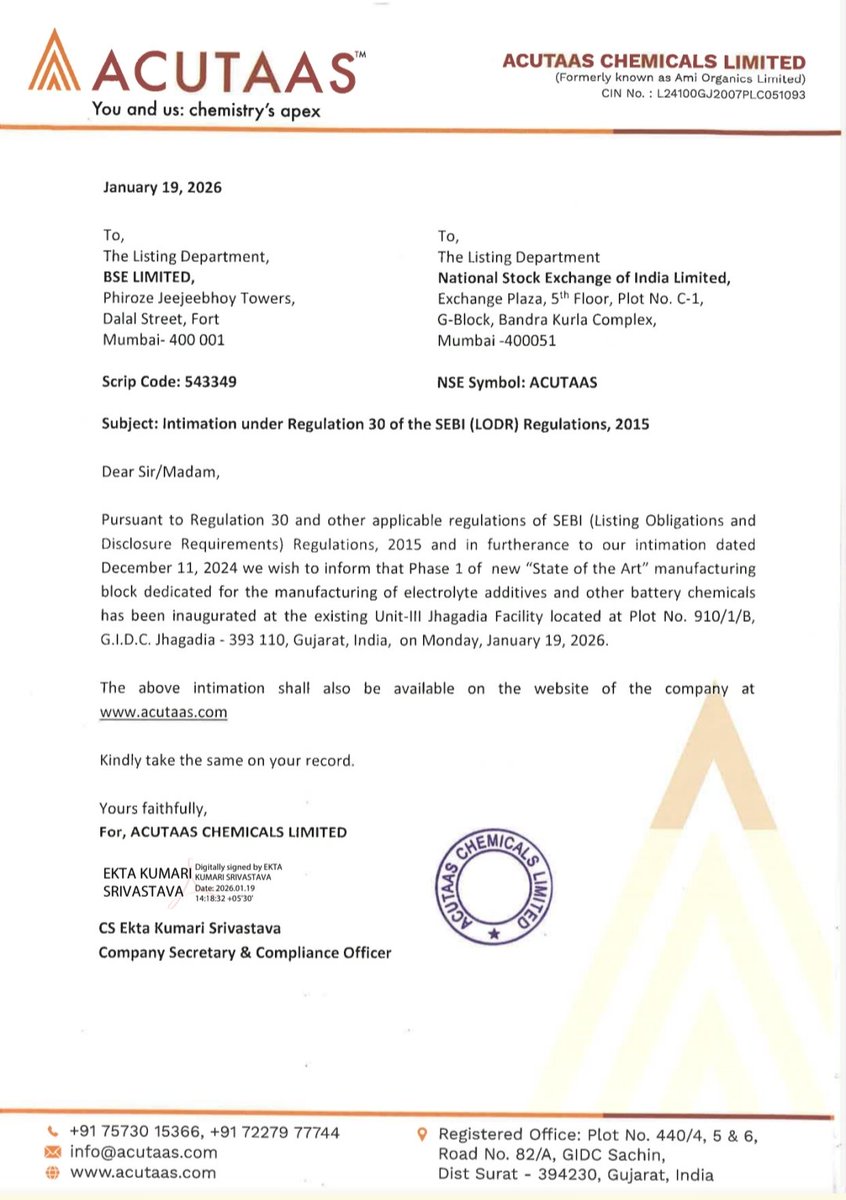

▪️ Key Update: Phase-1 of manufacturing block inaugurated

▪️ Focus Area: Electrolyte additives & advanced battery chemicals

▪️ Location: Unit-III, Jhagadia (Gujarat)

Why Tracking This ?

▪️ Electrolyte additives sit in the https://t.co/HbLQdhaMqT

🔶️ Aerospace

• HAL – Aircraft, helicopters, engines

TAM: ~INR 4T+ | FY25 Sales: 310 bn

• BDL – Missile systems

TAM: INR 500–700 bn | FY25 Sales: 33 bn

🔶️ Defence Electronics

• BEL – Radars, EW, comms, naval sensors

TAM: ~INR https://t.co/VtIZ6q6DJt

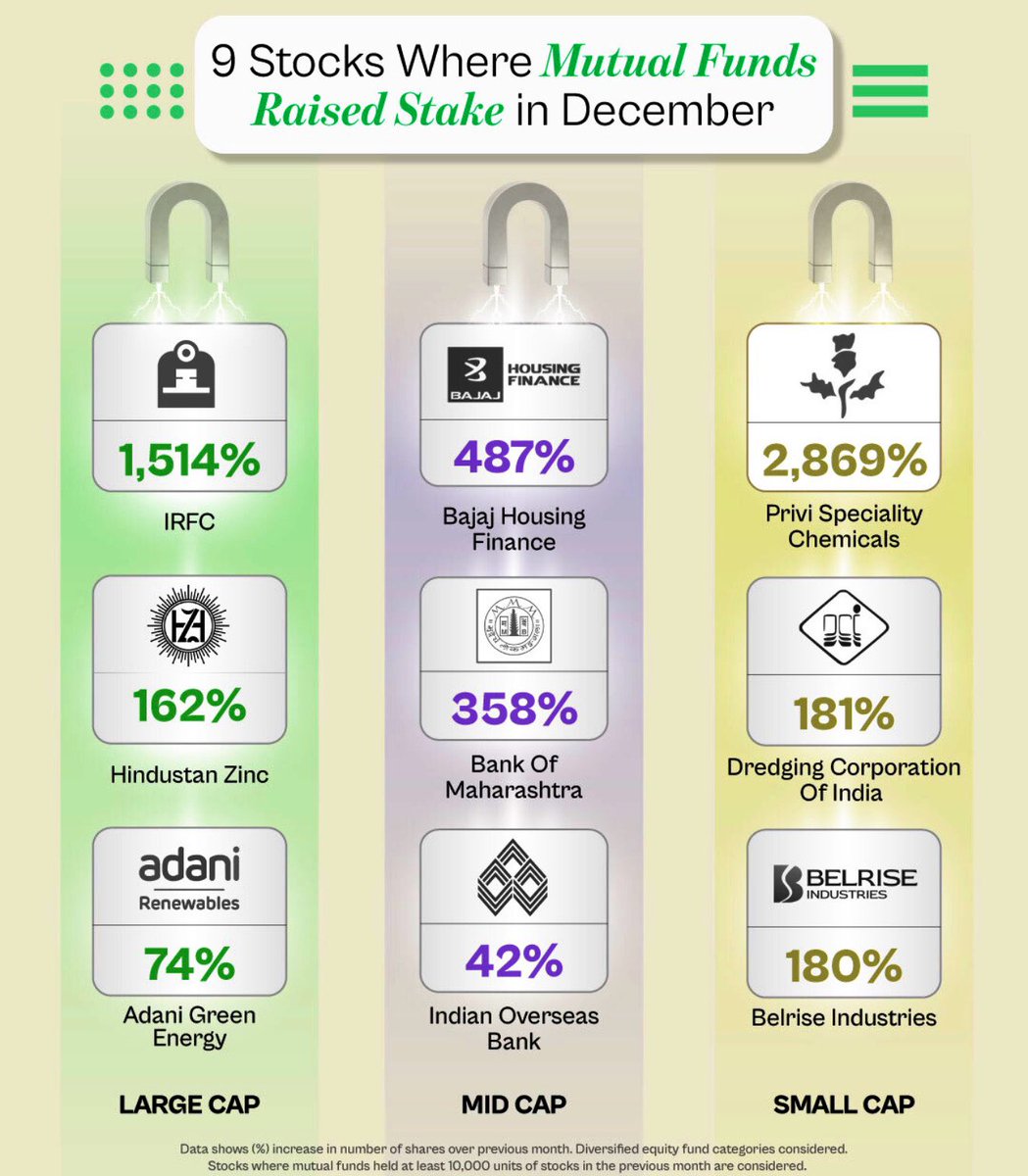

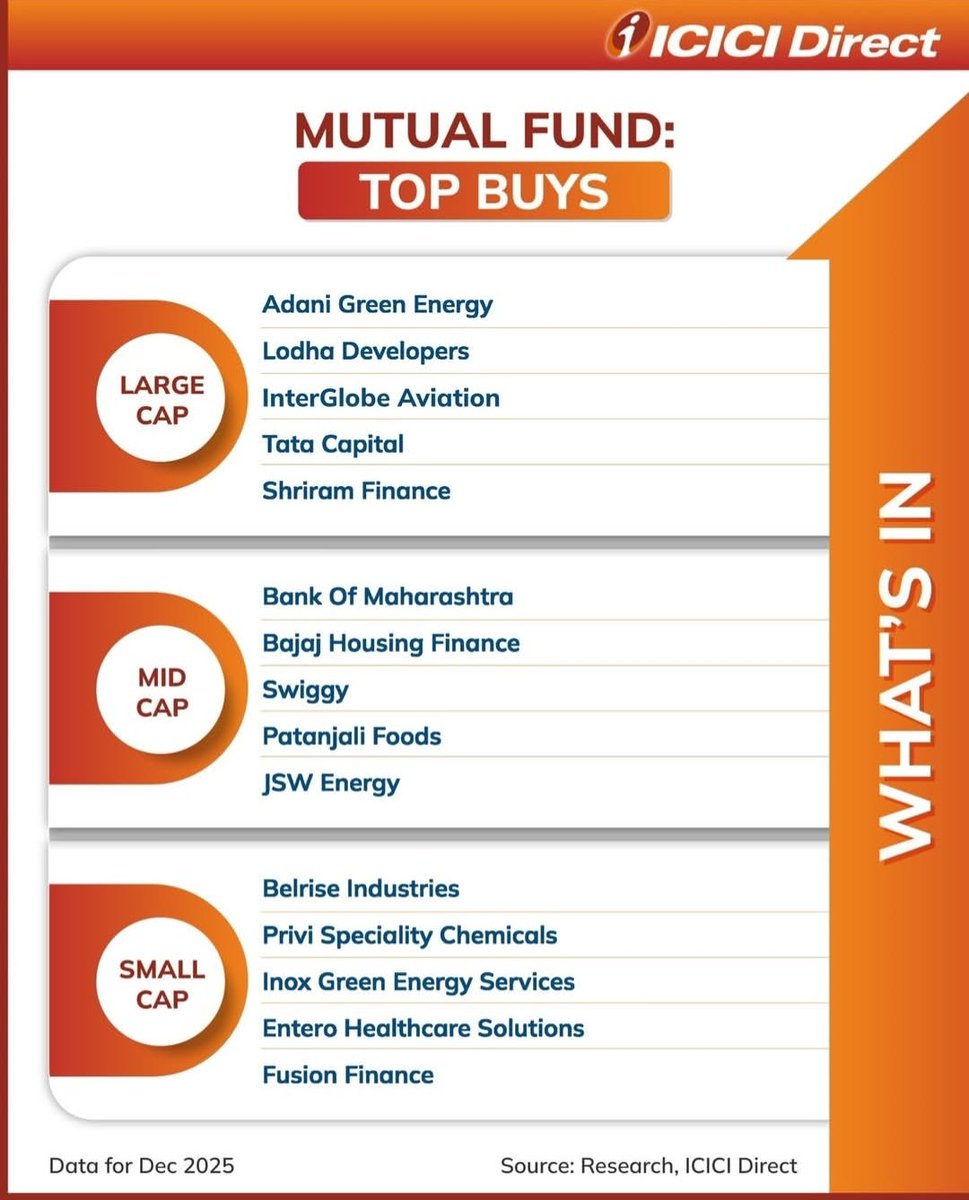

✦ Top Buys (Largecaps)

▪️ Adani Green Energy

▪️ Lodha Developers

▪️ InterGlobe Aviation

▪️ Tata Capital

▪️ Shriram Finance

✦ Top Buys (Midcaps)

▪️ Bank of Maharashtra

▪️ Bajaj Housing Finance

▪️ https://t.co/mtgc7Dr0t3

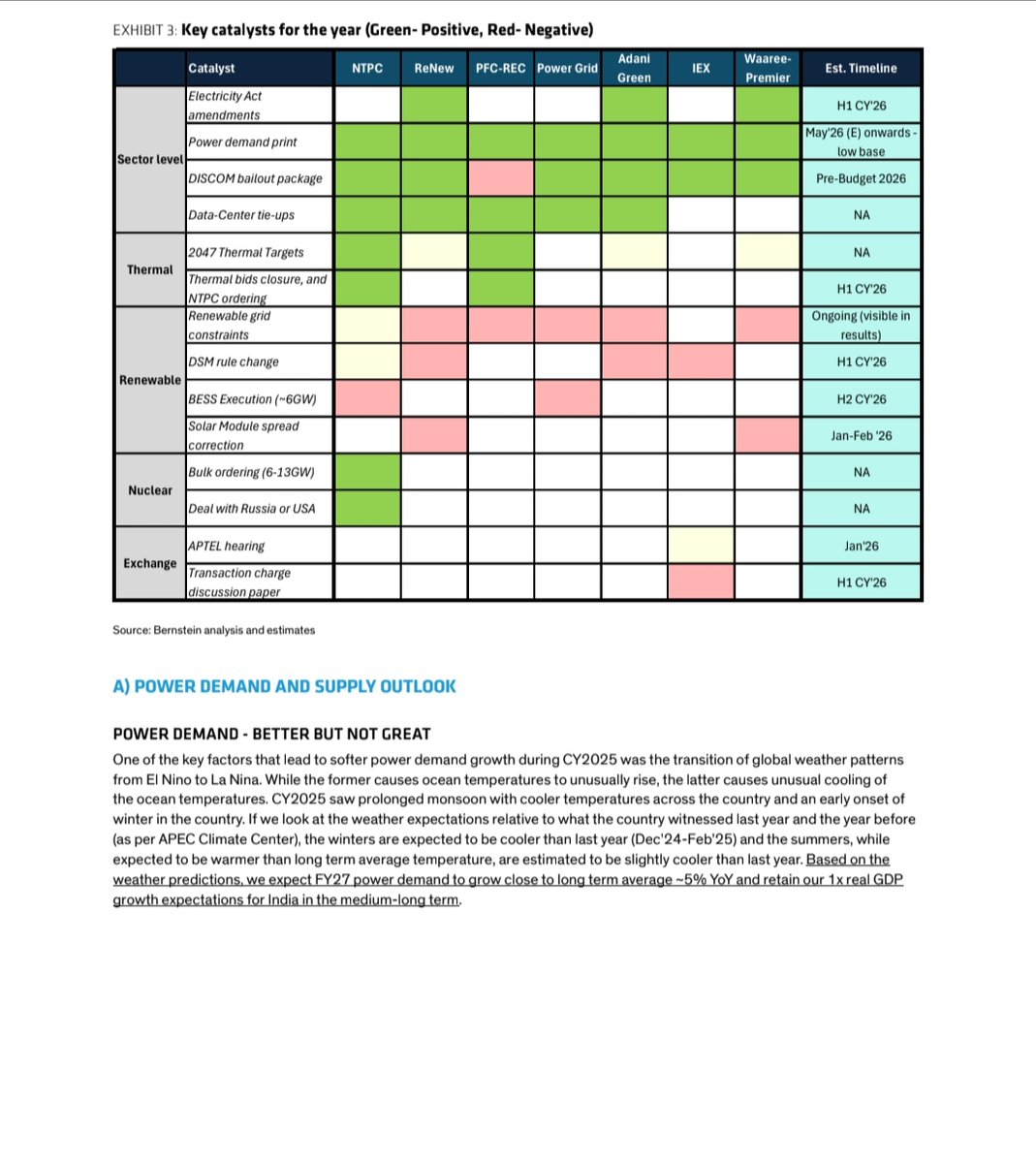

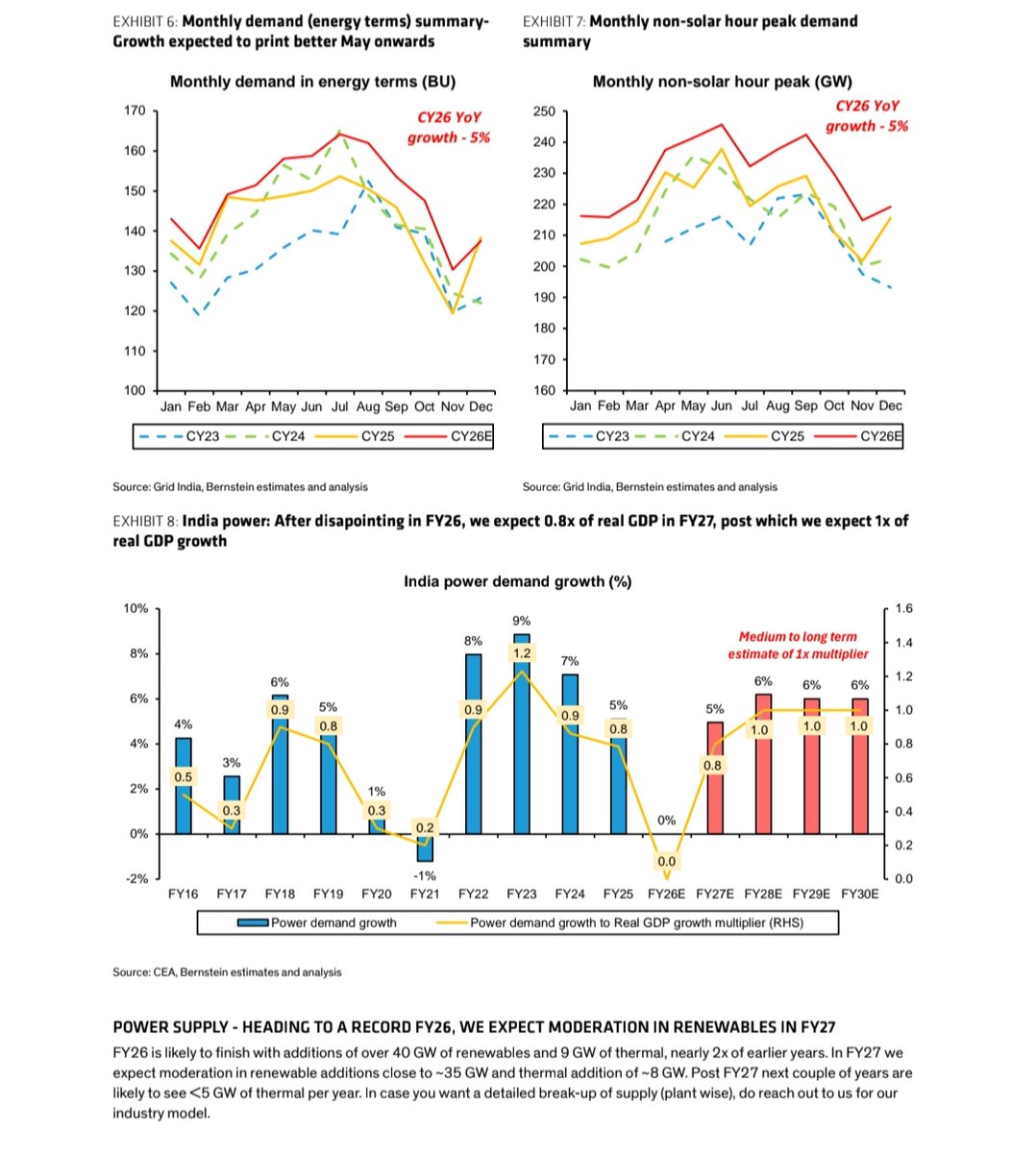

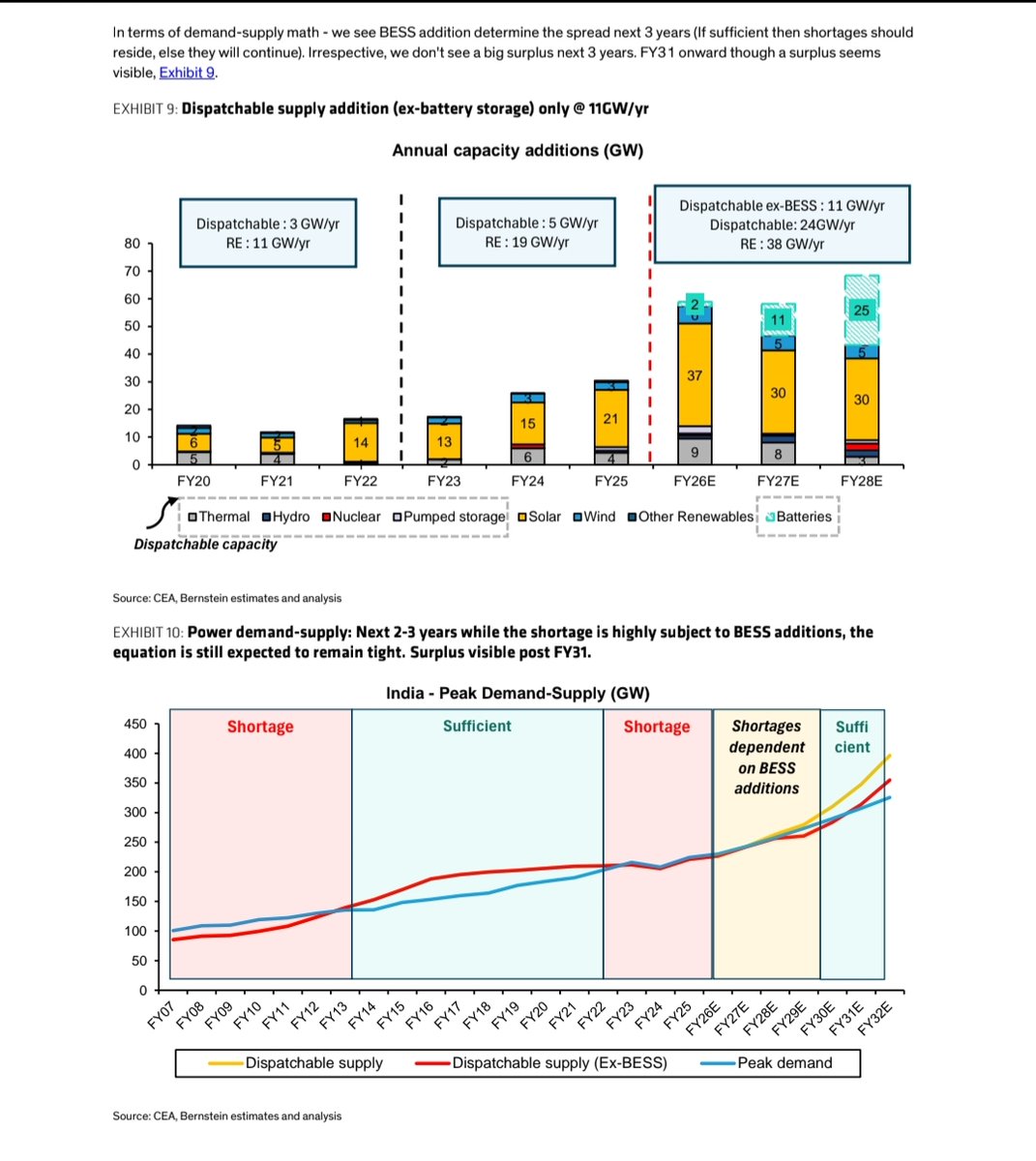

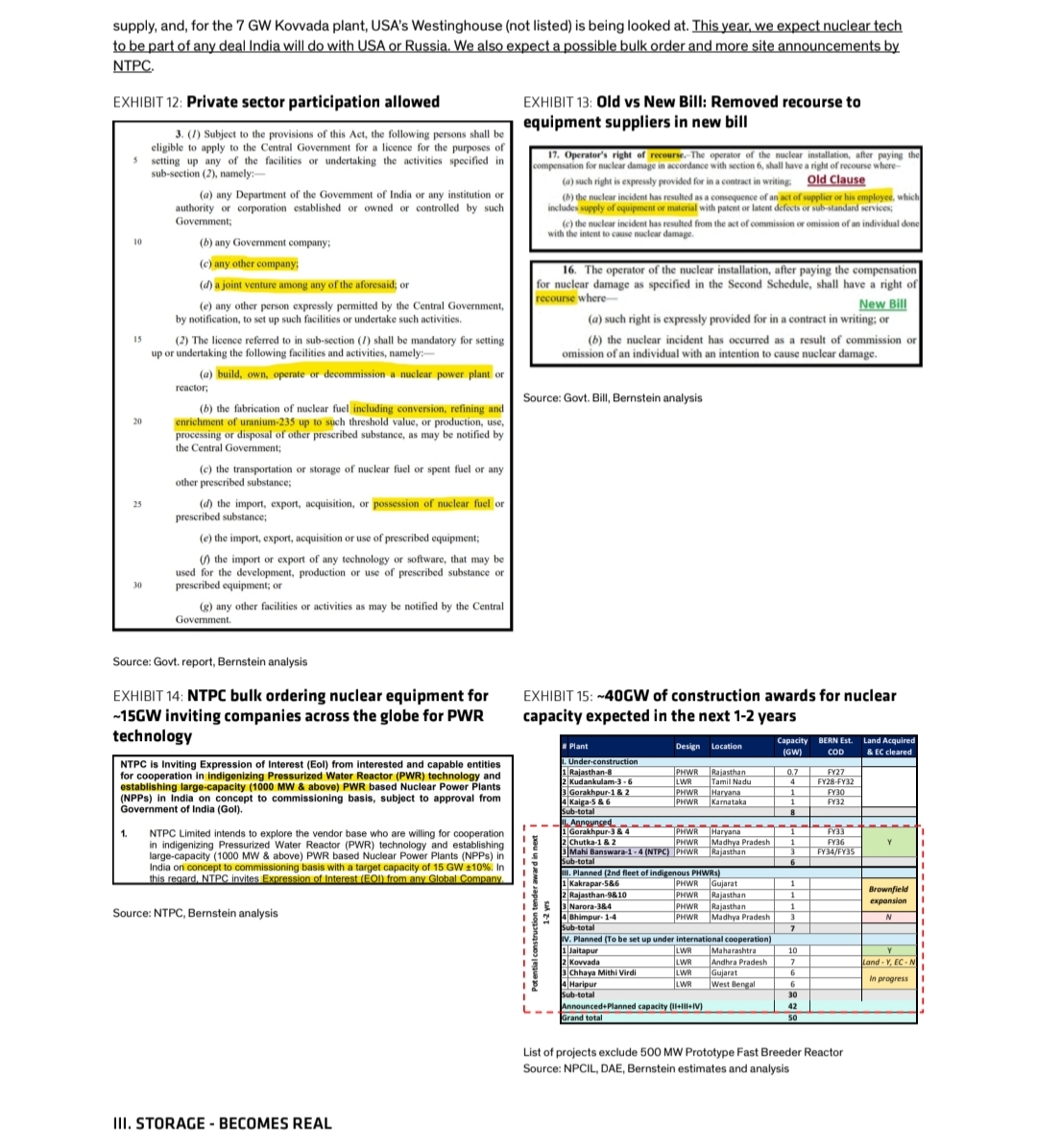

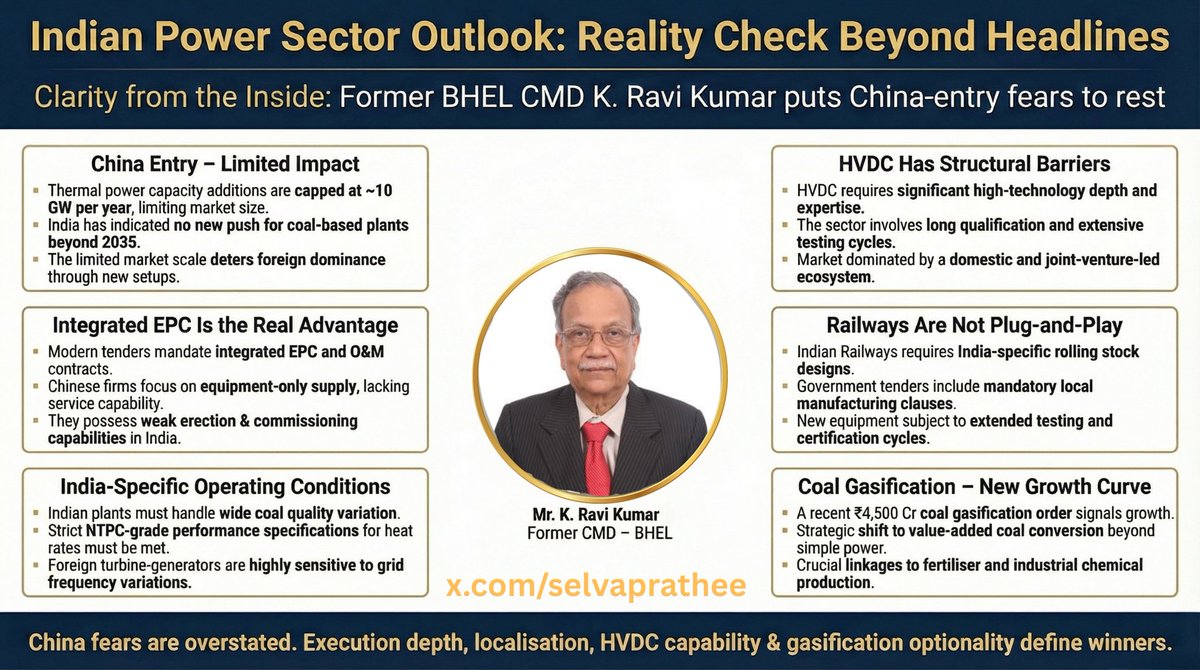

- From Energy Transition to Energy Addition, Reality Check Beyond Narratives

1⃣ Big Picture – What Changes in 2026 ?

▪️ Power demand recovery, but no boom

▪️ Renewables lose momentum due to grid + policy constraints

▪️ Nuclear, BESS https://t.co/nYunwwSKkg

▪️ Eicher Motors leads the group with a valuation exceeding ₹2 Lakh Cr, followed by Tata Motors.

▪️ Force Motors has the highest individual stock price, though it has a smaller overall market cap compared to the "Big Three" (Eicher, Tata, Ashok https://t.co/11WfVeF5K5

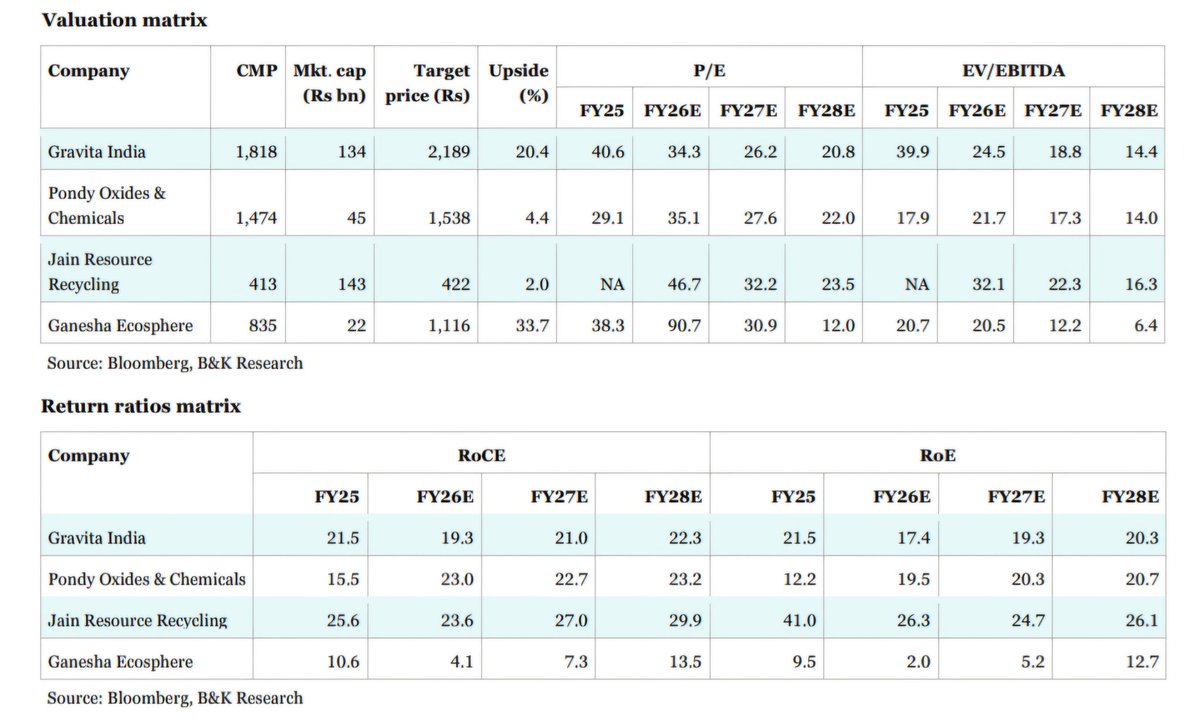

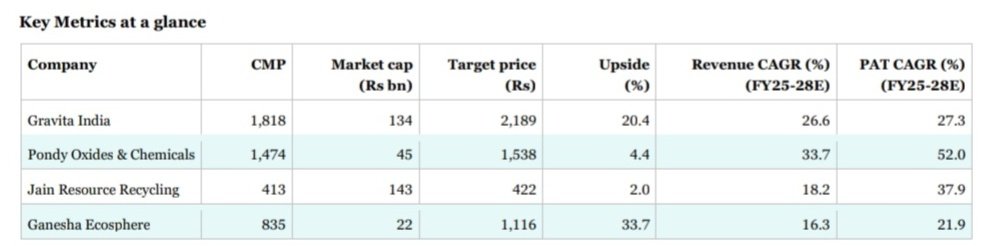

🔶️ Key Highlights

• Strong tailwinds in lead, copper, and plastic recycling

• Multi-year volume growth + margin expansion cycle underway

🔶️ Growth Outlook https://t.co/UpTvLwYTaK

- Clarity from the Inside, Why Chinese competition isn't a major threat

- Former BHEL CMD K. Ravi Kumar puts China entry fears to rest

1️⃣ China Entry – More Noise Than Risk

▪️ India currently has ~252 GW non-coal + https://t.co/1bTOyENVsA

No reviews yet

Be the first to share your experience!

Share Your Experience

Sign in with X to leave a review and help others discover great communities

Login with XLoading...

Be respectful and stay on-topic, stock market discussions only; no financial advice, promotions, misinformation, or illegal activities.

Community Rules

world becomes a better place when respect is the guiding principle

Tweet shoud be related to finance and investing

Users are not allowed to promote terrorism or engage in any activities that support or glorify terrorism.

Hateful Conduct: Users are not allowed to promote violence, threaten or harass other people based on race, ethnicity, gender, sexual orientation, disability

Abusive Behavior: Harassment and the promotion of violence or self-harm are strictly prohibited. This includes targeted abuse, doxxing

Users are not allowed to post excessively violent or adult content. Graphic images or media that could be considered offensive or disturbing may be removed.

Twitter prohibits spamming, misleading content, and any attempts to artificially amplify or suppress information. Automated accounts

Users should not impersonate others in a manner that is intended to deceive or mislead.

Sharing private information, such as addresses, phone numbers, or financial information, without consent is against the rules.

Users should respect copyright and trademark laws. Posting or sharing content that infringes on the intellectual property rights of others is not allowed.