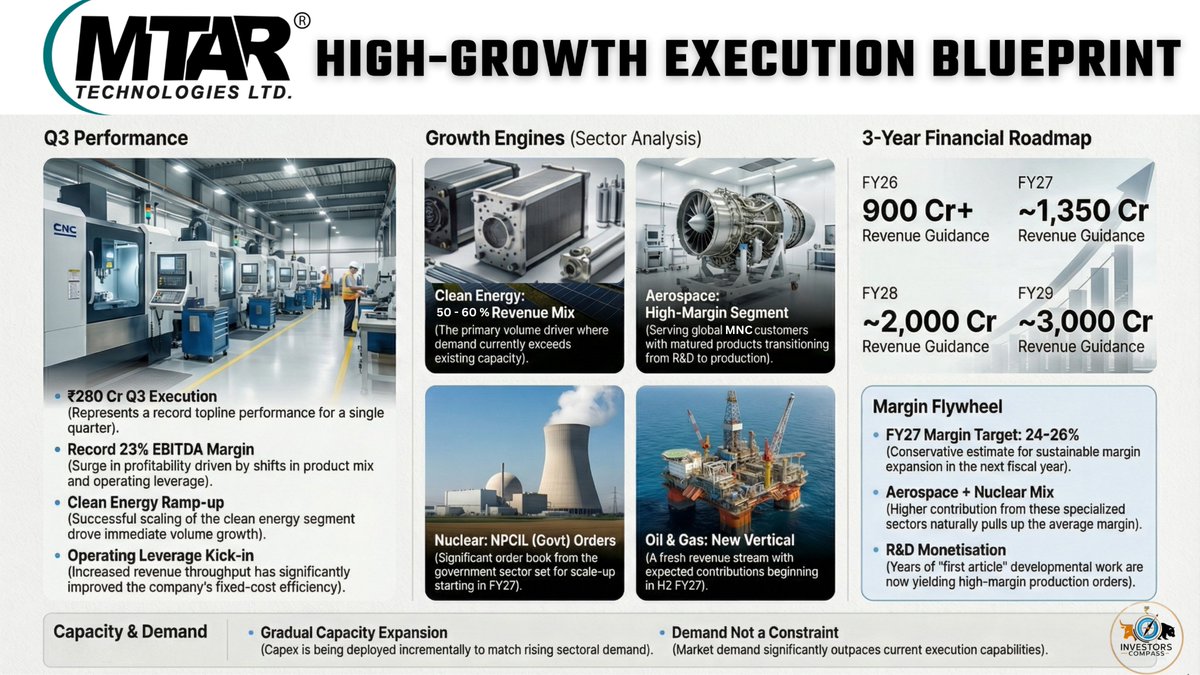

MTAR Technologies - High Growth Execution Blueprint

23% margins | 50% growth visibility | Multi engine scale up

1️⃣ Q3FY26 - What Changed on the Ground ?

▪️ Record execution led by Clean Energy ramp-up

▪️ Strong operating leverage kicked in as volumes scaled

▪️ Aerospace + https://t.co/ICO1IRDB1J

23% margins | 50% growth visibility | Multi engine scale up

1️⃣ Q3FY26 - What Changed on the Ground ?

▪️ Record execution led by Clean Energy ramp-up

▪️ Strong operating leverage kicked in as volumes scaled

▪️ Aerospace + https://t.co/ICO1IRDB1J

2

11

47

20.1K

48

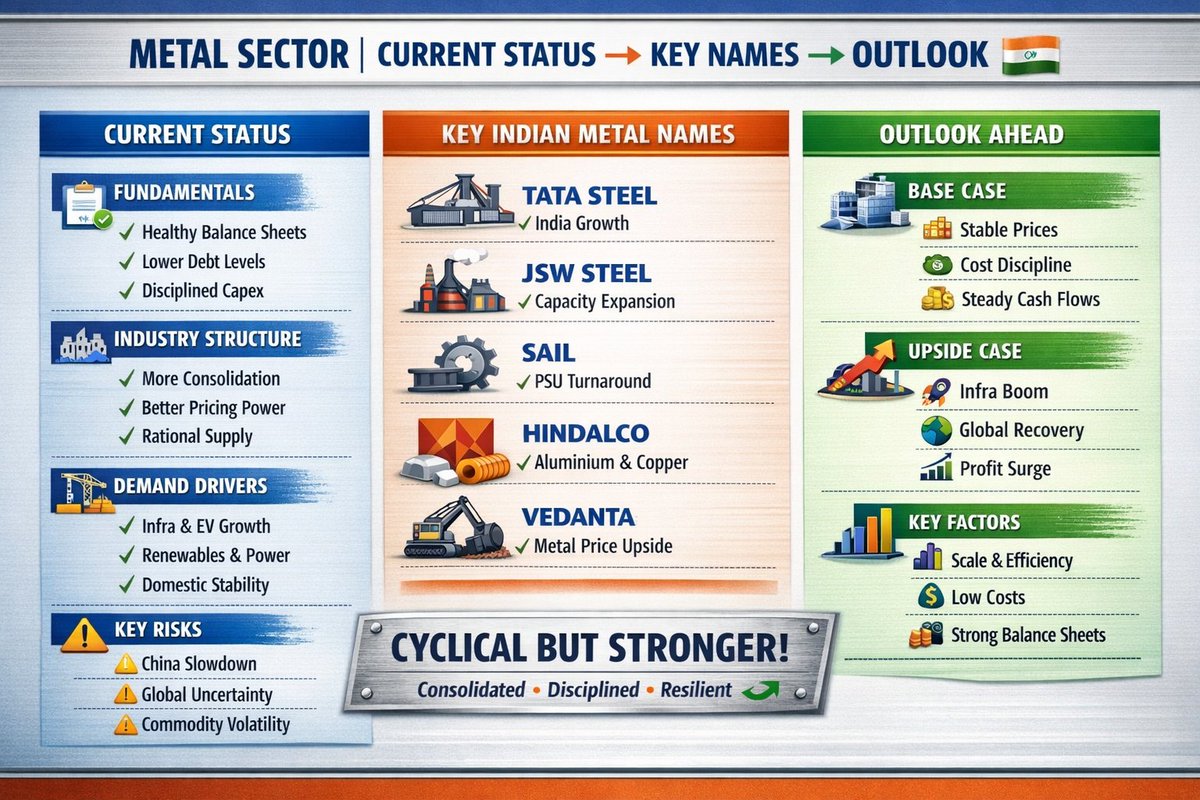

🇮🇳 Economic Survey 2025-26: Important Sectors

Core Theme:

From Import Substitution to Strategic Indispensability.

Single Takeaway:

It doesn’t abandon services, but clearly argues that manufacturing depth, energy security, and productive capacity are essential for India’s next https://t.co/kC9pl5A9mx

Core Theme:

From Import Substitution to Strategic Indispensability.

Single Takeaway:

It doesn’t abandon services, but clearly argues that manufacturing depth, energy security, and productive capacity are essential for India’s next https://t.co/kC9pl5A9mx

8

0

19

15.6K

5

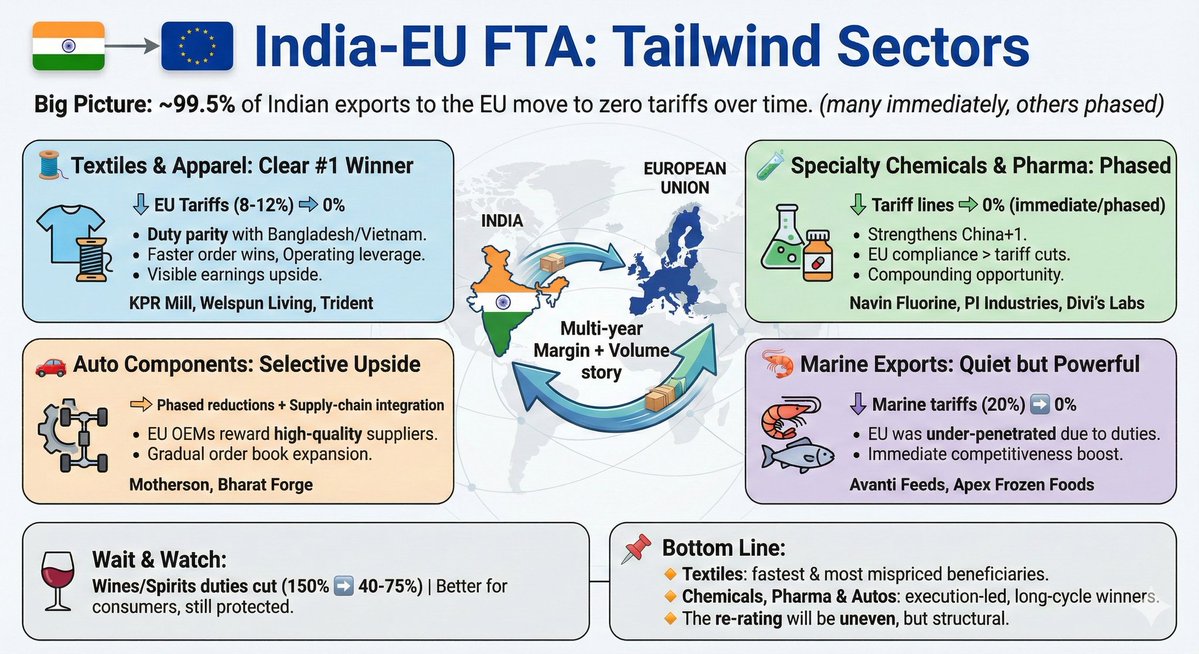

🇮🇳 🇪🇺 India - EU FTA: Tailwind Sectors

Big Picture: ~99.5% of Indian exports to the EU move to zero tariffs over time.

(many immediately, others phased)

Result: Multi-year Margin + Volume story.

🧵 Textiles & Apparel: Clear #1 Winner

🔹️ Change: EU tariffs (8-12%) ➡️ 0% for https://t.co/YQ876Md7ZP

Big Picture: ~99.5% of Indian exports to the EU move to zero tariffs over time.

(many immediately, others phased)

Result: Multi-year Margin + Volume story.

🧵 Textiles & Apparel: Clear #1 Winner

🔹️ Change: EU tariffs (8-12%) ➡️ 0% for https://t.co/YQ876Md7ZP

5

2

21

29.0K

6

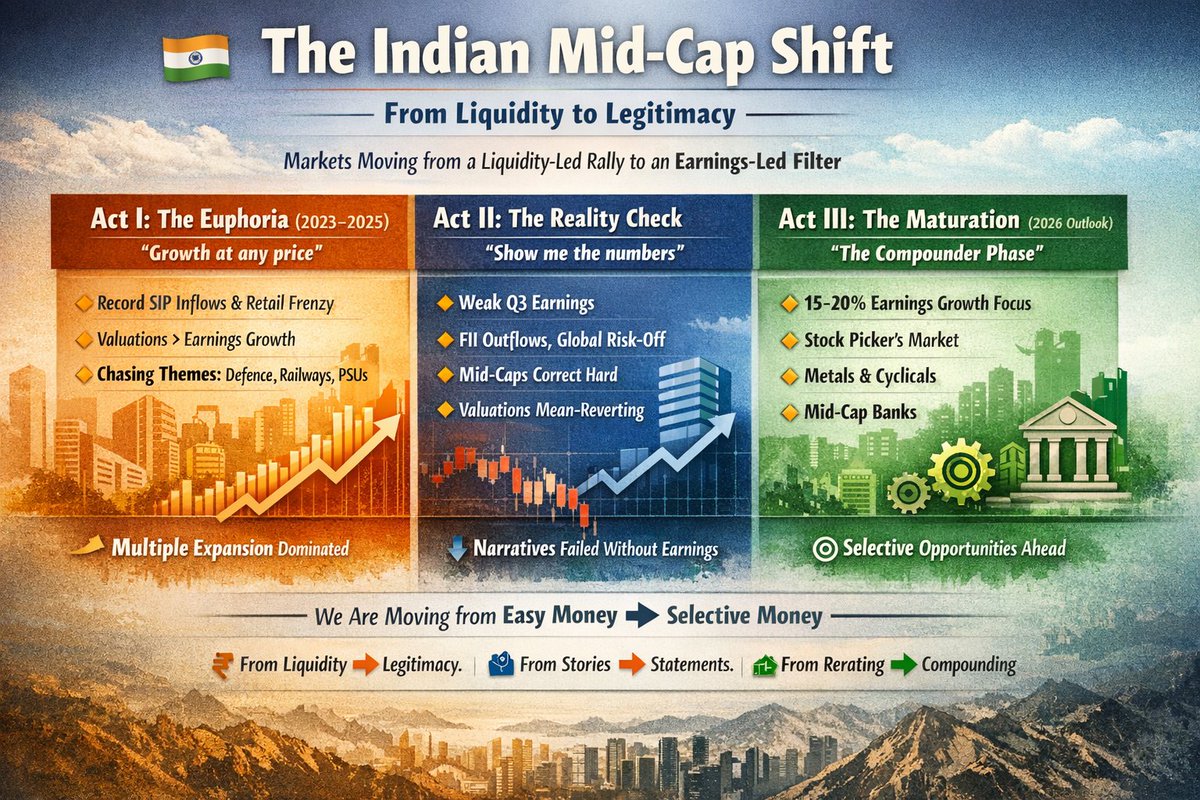

🇮🇳 The Indian Mid-Cap Shift

Mid-cap story is changing.

From Liquidity to Legitimacy.

Markets are moving from a Liquidity-led Rally to an Earnings-led Filter.

🎭 Act I: The Euphoria (2023 - 2025)

“Growth at any price”

🔸 Record SIP inflows + Retail participation drove returns. https://t.co/BmbhQUm7WE

Mid-cap story is changing.

From Liquidity to Legitimacy.

Markets are moving from a Liquidity-led Rally to an Earnings-led Filter.

🎭 Act I: The Euphoria (2023 - 2025)

“Growth at any price”

🔸 Record SIP inflows + Retail participation drove returns. https://t.co/BmbhQUm7WE

6

2

18

7.9K

1

🇮🇳 India’s Data Center Landscape (2025-2027)

Power > Land > Chips.

AI is becoming a Physical Infra story.

Data Centers are the factories.

India is moving from Cloud Storage ➡️ Sovereign AI Infra.

This changes where the money is made.

🔑 THE CORE SHIFT

The bottleneck has https://t.co/pqFJGN2vmf

Power > Land > Chips.

AI is becoming a Physical Infra story.

Data Centers are the factories.

India is moving from Cloud Storage ➡️ Sovereign AI Infra.

This changes where the money is made.

🔑 THE CORE SHIFT

The bottleneck has https://t.co/pqFJGN2vmf

8

1

25

15.8K

5

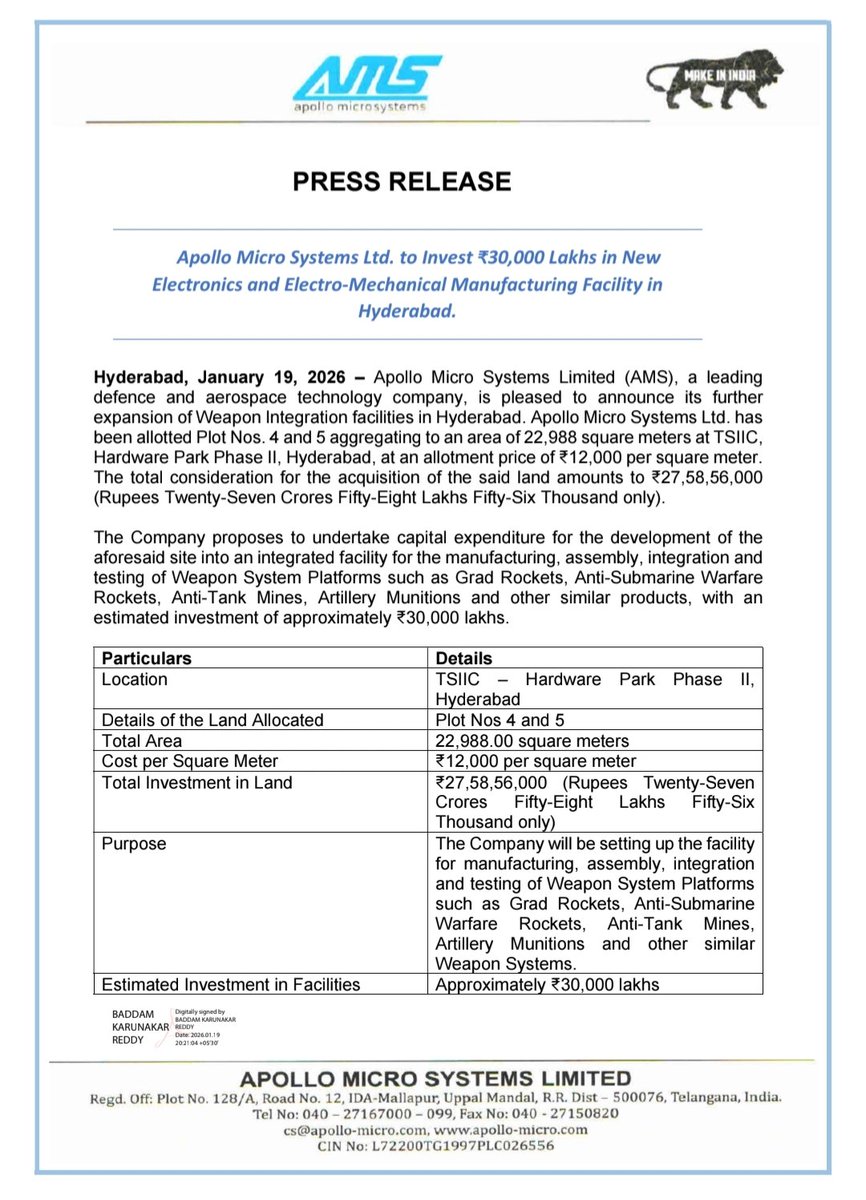

Apollo Micro Systems - Big Capacity + Capability Expansion

- Structural Defence Manufacturing Trigger

▪️ ₹300 Cr Capex announced for new Electronics & Electro Mechanical manufacturing facility

▪️ Land acquired - 22,988 sq. meters at TSIIC Hardware Park Phase II, Hyderabad

▪️ https://t.co/C9Ez2xKehr

- Structural Defence Manufacturing Trigger

▪️ ₹300 Cr Capex announced for new Electronics & Electro Mechanical manufacturing facility

▪️ Land acquired - 22,988 sq. meters at TSIIC Hardware Park Phase II, Hyderabad

▪️ https://t.co/C9Ez2xKehr

0

4

28

11.1K

22

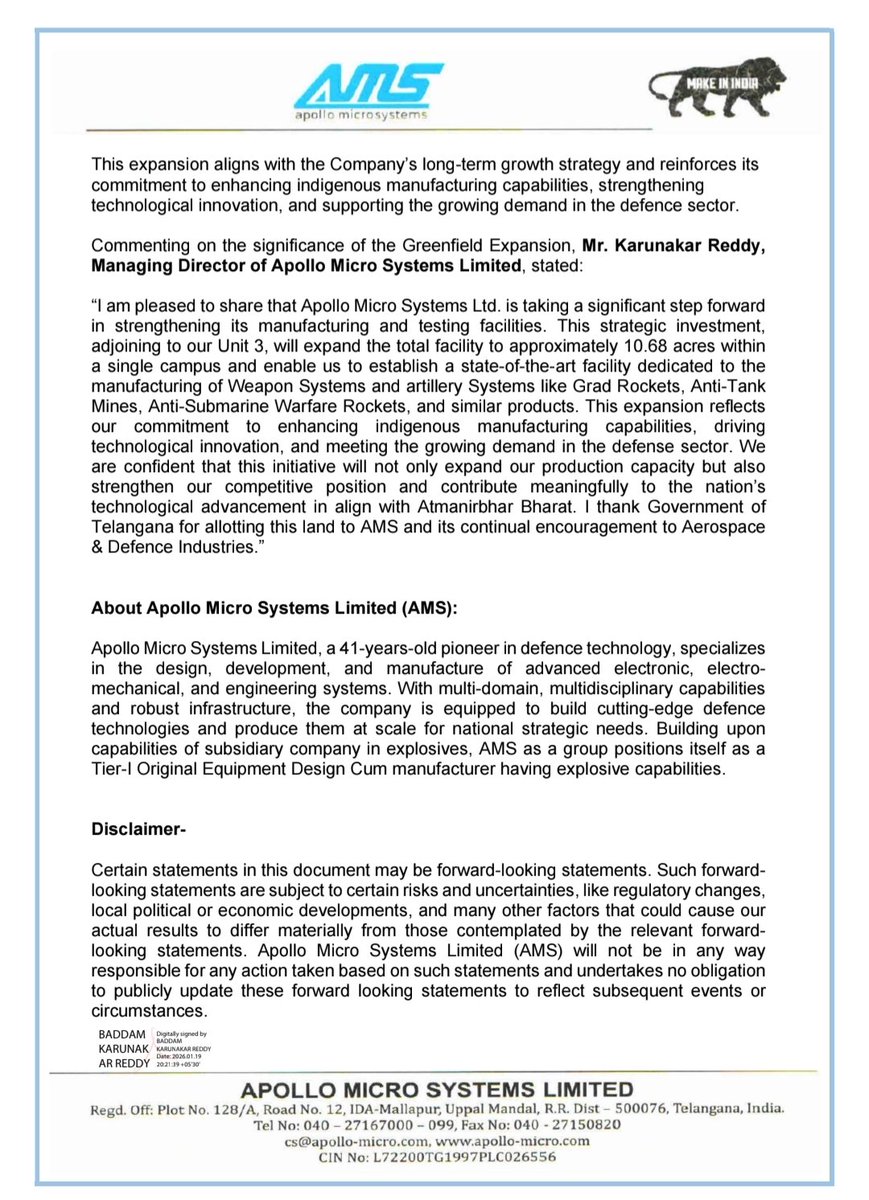

Interarch Building Products – Execution Flywheel Accelerates ?

Execution > Capacity > Volumes > Cash Flow Normalisation

1⃣ Execution & Volume Growth – Stronger Than Guidance

▪️ Company is in the higher end of execution cycle

▪️ Q2 execution speed materially higher than Q1

▪️ https://t.co/YhPW70cbxF

Execution > Capacity > Volumes > Cash Flow Normalisation

1⃣ Execution & Volume Growth – Stronger Than Guidance

▪️ Company is in the higher end of execution cycle

▪️ Q2 execution speed materially higher than Q1

▪️ https://t.co/YhPW70cbxF

2

5

38

17.4K

32

🏢 UBS on Indian Midcaps - Selectivity > Broad Bets

Midcaps have corrected, but the rerating story isn’t dead - it’s becoming stock-specific.

▪️ Valuation reset: Midcap 1Y forward PE down ~10% in 2025, yet still at a premium vs Nifty & 5Y avg

▪️ Flow reality: Domestic funds https://t.co/AvJkRCXteY

Midcaps have corrected, but the rerating story isn’t dead - it’s becoming stock-specific.

▪️ Valuation reset: Midcap 1Y forward PE down ~10% in 2025, yet still at a premium vs Nifty & 5Y avg

▪️ Flow reality: Domestic funds https://t.co/AvJkRCXteY

11

9

35

24.9K

10

Transrail Wins ₹527 Cr EPC Orders | HTLS reconductoring - new trigger ?

▪️ Order Value: ₹527 Cr across MENA, Africa + India

▪️ Order Mix: Mix across T&D, Poles, Lighting.

▪️Added HTLS reconductoring capability in India

▪️ FY26 YTD Order Inflows: ₹5,637 Cr

▪️ L1 Pipeline: https://t.co/3AylFUezSt

▪️ Order Value: ₹527 Cr across MENA, Africa + India

▪️ Order Mix: Mix across T&D, Poles, Lighting.

▪️Added HTLS reconductoring capability in India

▪️ FY26 YTD Order Inflows: ₹5,637 Cr

▪️ L1 Pipeline: https://t.co/3AylFUezSt

2

3

29

13.1K

11

My Stock Screener for Future Re-Rating Stories

Just like Quantitative Screeners, I frequently use the following Qualitative Screener on ChatGPT.

🔍 ChatGPT STOCK SCREENER PROMPT

Act as a long-term equity investor focused on generating 5-year alpha, not momentum or quality https://t.co/41Ga2ujl02

Just like Quantitative Screeners, I frequently use the following Qualitative Screener on ChatGPT.

🔍 ChatGPT STOCK SCREENER PROMPT

Act as a long-term equity investor focused on generating 5-year alpha, not momentum or quality https://t.co/41Ga2ujl02

4

1

24

1.0K

6

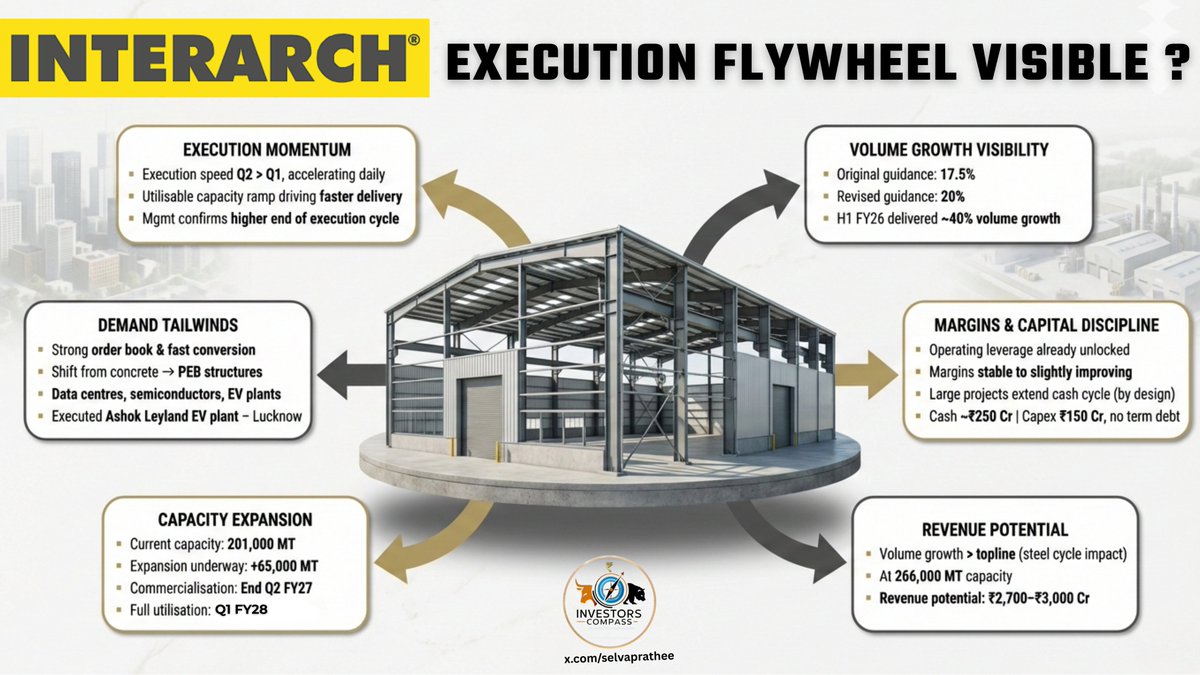

🏆 Top 10 Gold ETFs 🇮🇳

🥇 Invesco India Gold ETF

🥈 Axis Gold ETF

🥉 UTI Gold ETF

▪️ ICICI Pru Gold ETF

▪️ LIC Gold ETF

▪️ SBI Gold ETF

▪️ Quantum Gold ETF

▪️ DSP Gold ETF

▪️ Kotak Gold ETF

▪️ Zerodha Gold ETF (GOLDCASE)

💭 Are you tracking any of these Gold ETF’s or Silver https://t.co/gN7B3BABOY

🥇 Invesco India Gold ETF

🥈 Axis Gold ETF

🥉 UTI Gold ETF

▪️ ICICI Pru Gold ETF

▪️ LIC Gold ETF

▪️ SBI Gold ETF

▪️ Quantum Gold ETF

▪️ DSP Gold ETF

▪️ Kotak Gold ETF

▪️ Zerodha Gold ETF (GOLDCASE)

💭 Are you tracking any of these Gold ETF’s or Silver https://t.co/gN7B3BABOY

13

7

47

23.1K

11

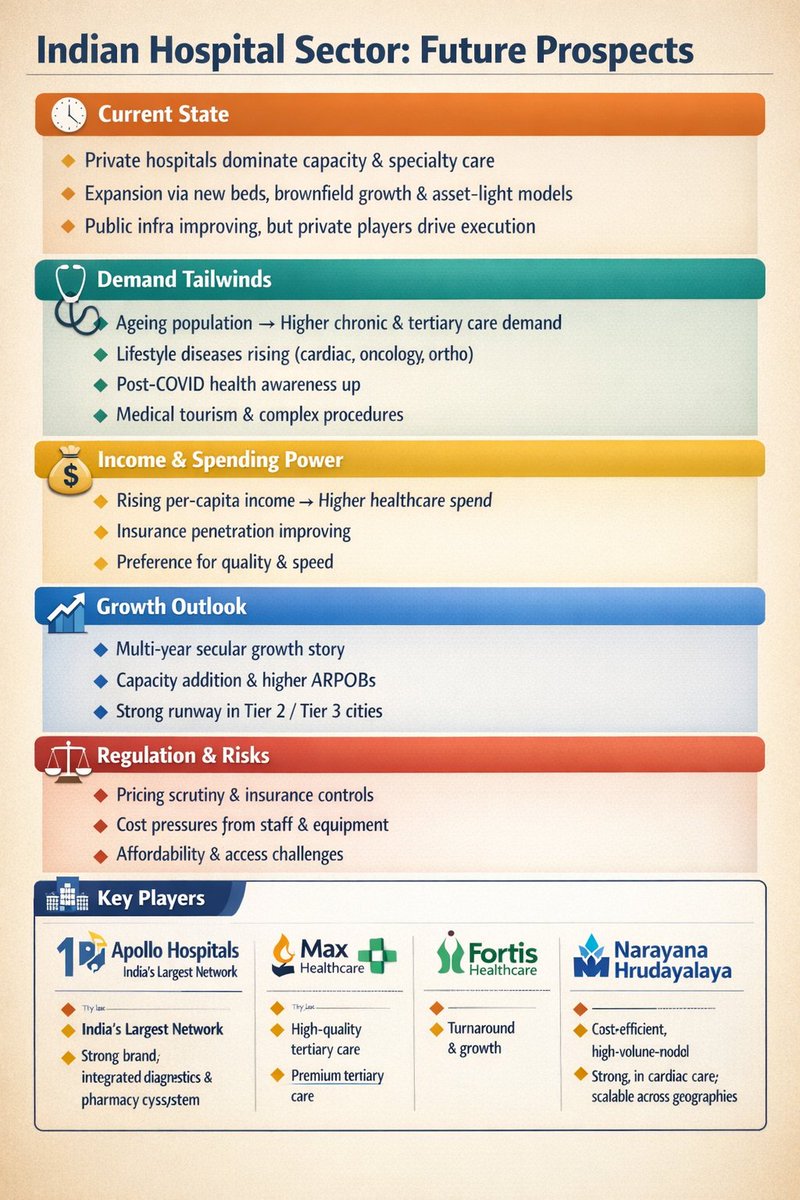

🇮🇳 Hospital Sector: Future Prospects

⏰ Current State

🔸 Private hospitals dominate capacity, quality & specialty care.

🔸 Expansion via new beds, brownfield growth & asset-light models.

🔸 Public infra improving, but private players drive execution.

🩺 Demand Tailwinds

🔸 https://t.co/U0wLvClZD5

⏰ Current State

🔸 Private hospitals dominate capacity, quality & specialty care.

🔸 Expansion via new beds, brownfield growth & asset-light models.

🔸 Public infra improving, but private players drive execution.

🩺 Demand Tailwinds

🔸 https://t.co/U0wLvClZD5

6

4

30

3.1K

17

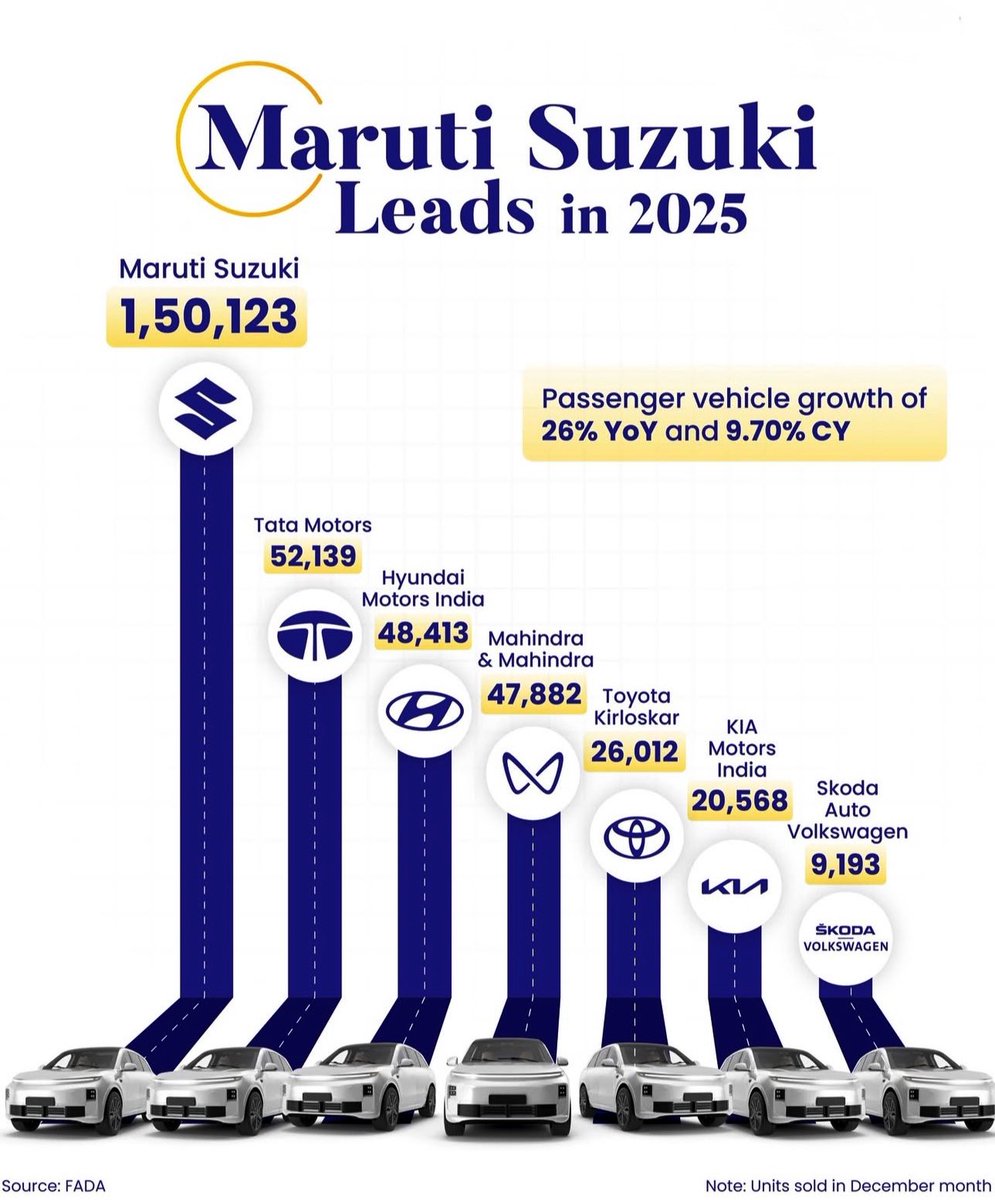

Top 10 Best-Selling Car Models - 2025

Maruti Suzuki Baleno - 22,108

Maruti Suzuki Fronx - 20,706

Tata Nexon - 19,375

Maruti Suzuki Dzire - 19,072

Maruti Suzuki Swift - 18,767

Maruti Suzuki Brezza - 18,704

Maruti Suzuki Ertiga - 16,586

Tata Punch - 15,980

Mahindra Scorpio - https://t.co/Slg5kNPKO3

Maruti Suzuki Baleno - 22,108

Maruti Suzuki Fronx - 20,706

Tata Nexon - 19,375

Maruti Suzuki Dzire - 19,072

Maruti Suzuki Swift - 18,767

Maruti Suzuki Brezza - 18,704

Maruti Suzuki Ertiga - 16,586

Tata Punch - 15,980

Mahindra Scorpio - https://t.co/Slg5kNPKO3

4

1

23

3.4K

1

Two Insulator stocks To study

- Two names to study (recent buzz)

1⃣ Yash Highvoltage - Promoter buying spree

2⃣ Modern Insulator - Excellent Export Data

1 | Yash Highvoltage

▪️ Business focus: Transformer bushings – OIP today, RIP / RIS (up to 550 kV) next phase

▪️ High https://t.co/m2Td2Ils3e

- Two names to study (recent buzz)

1⃣ Yash Highvoltage - Promoter buying spree

2⃣ Modern Insulator - Excellent Export Data

1 | Yash Highvoltage

▪️ Business focus: Transformer bushings – OIP today, RIP / RIS (up to 550 kV) next phase

▪️ High https://t.co/m2Td2Ils3e

1

15

84

21.9K

77

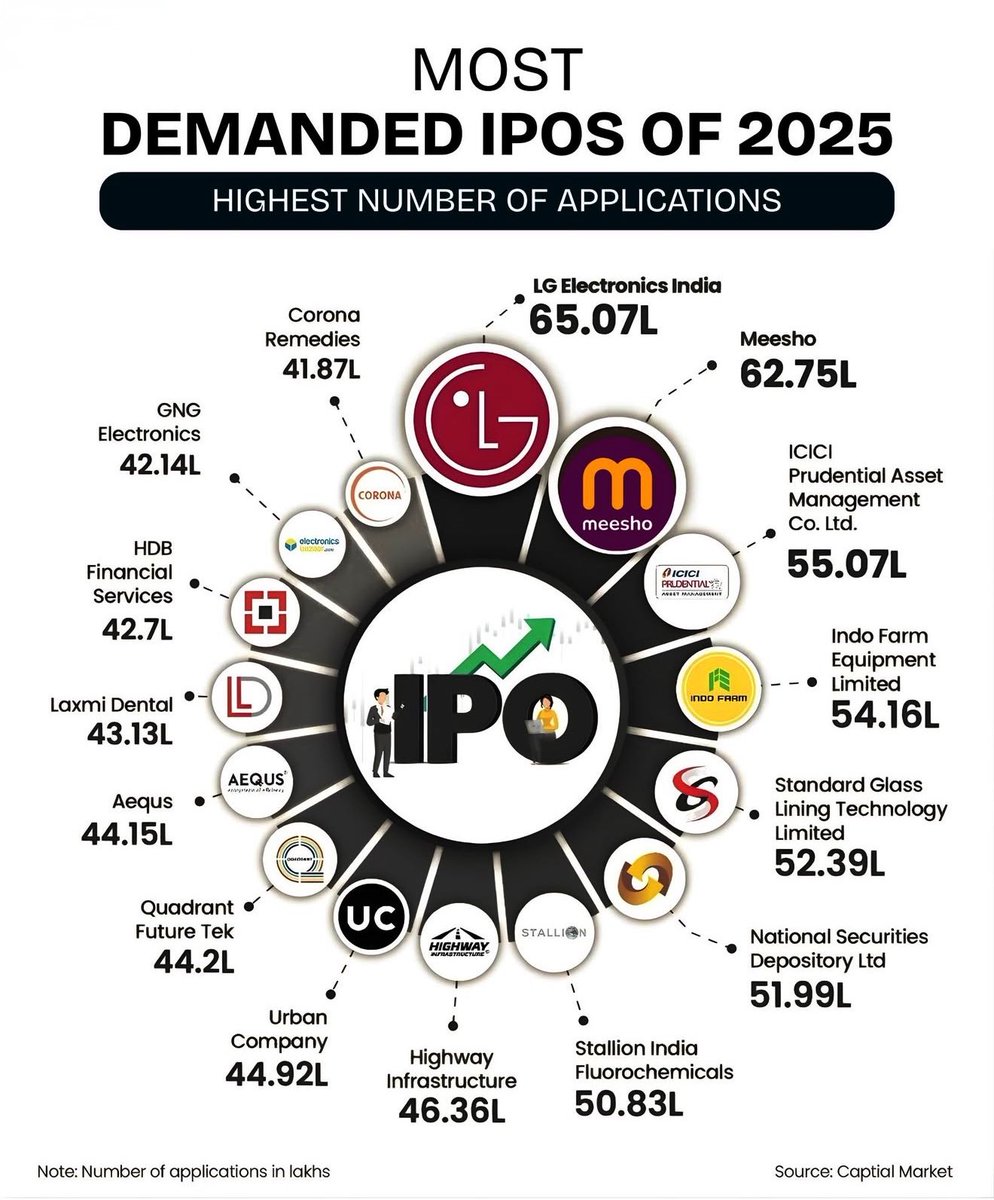

📊 Most Demanded IPOs - 2025

🥇 LG Electronics India

🥈 Meesho

🥉 ICICI Prudential AMC

▪️ Indo Farm Equipment Limited

▪️ Standard Glass Lining

▪️ NSDL

▪️ Stallion India Fluorochemicals

▪️ Highway Infrastructure

▪️ Urban Company

▪️ Quadrant Future Tek

▪️ Aequs

▪️ Laxmi Dental

▪️ https://t.co/k66DDMDSVt

🥇 LG Electronics India

🥈 Meesho

🥉 ICICI Prudential AMC

▪️ Indo Farm Equipment Limited

▪️ Standard Glass Lining

▪️ NSDL

▪️ Stallion India Fluorochemicals

▪️ Highway Infrastructure

▪️ Urban Company

▪️ Quadrant Future Tek

▪️ Aequs

▪️ Laxmi Dental

▪️ https://t.co/k66DDMDSVt

15

3

39

21.1K

13

23.6K

Total Members

+ 2

24h Growth

+ 5

7d Growth

Date Members Change

Feb 10, 2026 23.6K +2

Feb 9, 2026 23.6K +3

Feb 8, 2026 23.6K +3

Feb 7, 2026 23.6K +1

Feb 6, 2026 23.6K -2

Feb 5, 2026 23.6K -2

Feb 4, 2026 23.6K +6

Feb 3, 2026 23.6K -1

Feb 2, 2026 23.6K +0

Feb 1, 2026 23.6K +3

Jan 31, 2026 23.6K +3

Jan 30, 2026 23.6K -4

Jan 29, 2026 23.6K +3

Jan 28, 2026 23.6K —

No reviews yet

Be the first to share your experience!

Share Your Experience

Sign in with X to leave a review and help others discover great communities

Login with XLoading...

A community of Stock Market Traders & Investors in India. Discussions related to stocks, trading, F&O in India. Join the Community Now!

Community Rules

Be kind and respectful. No Personal Attack.

Tweet should not attack or harrass anyone in the community

Keep Posts about Indian Stock Market topics

The Discussions should be related to stock market investing, trading, derivatives - F&O & Commodity trading in India.

No Spam or Irrelevent Topics

Do not post about Irrelevent Topics in this community or will be banned from this community