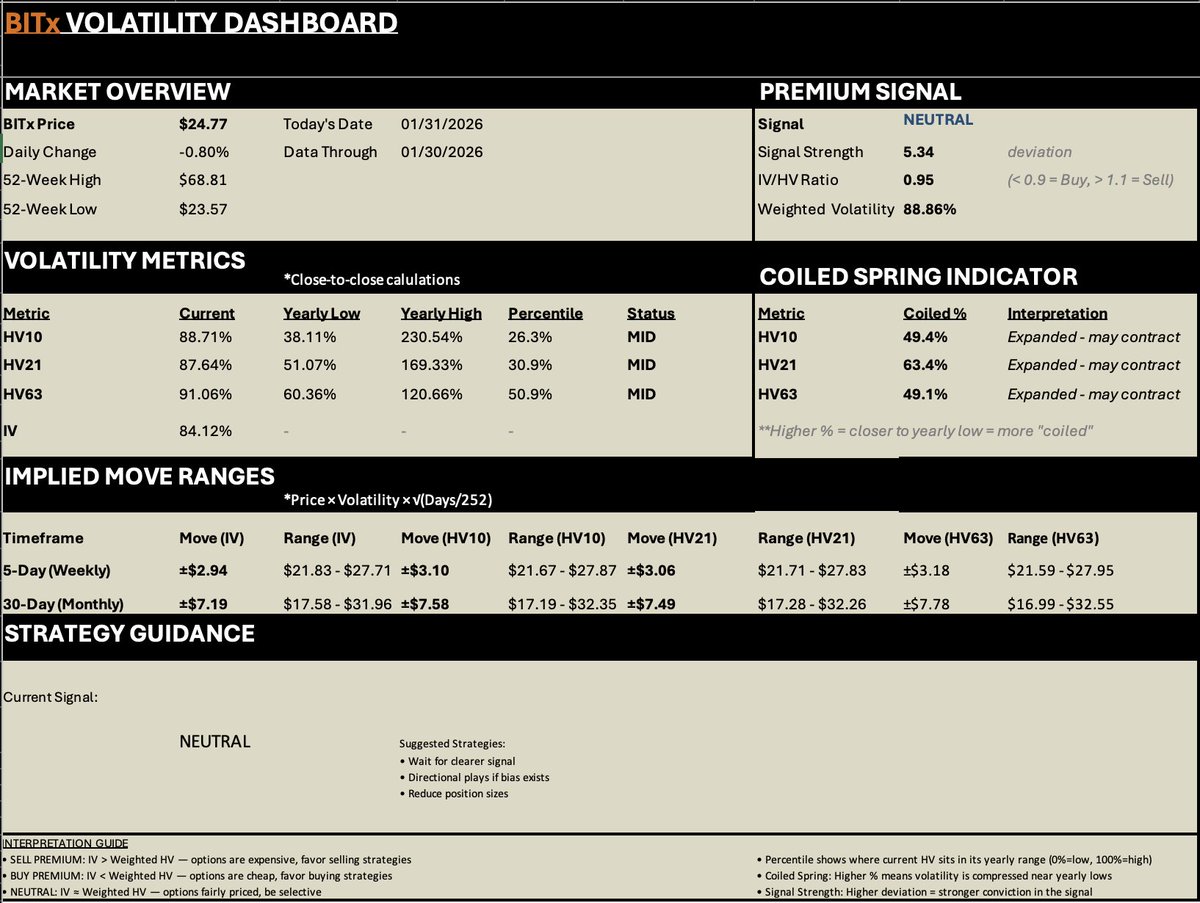

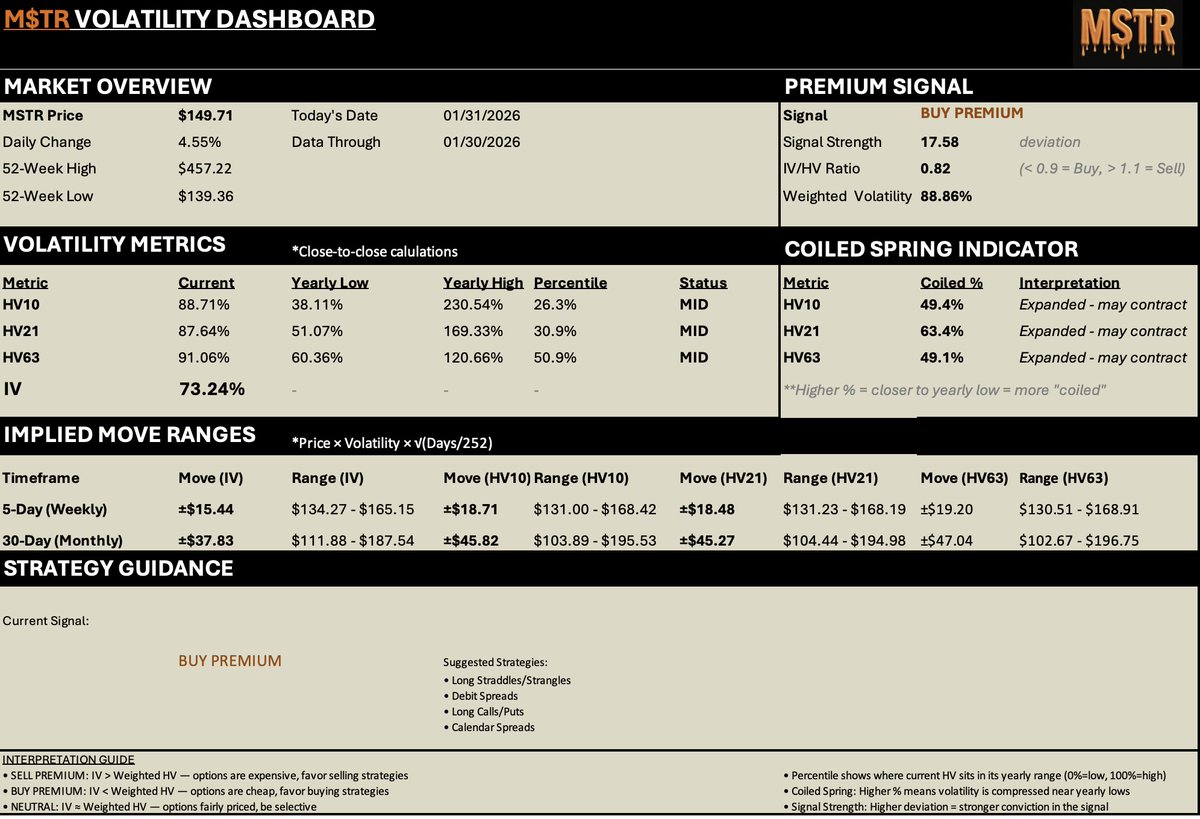

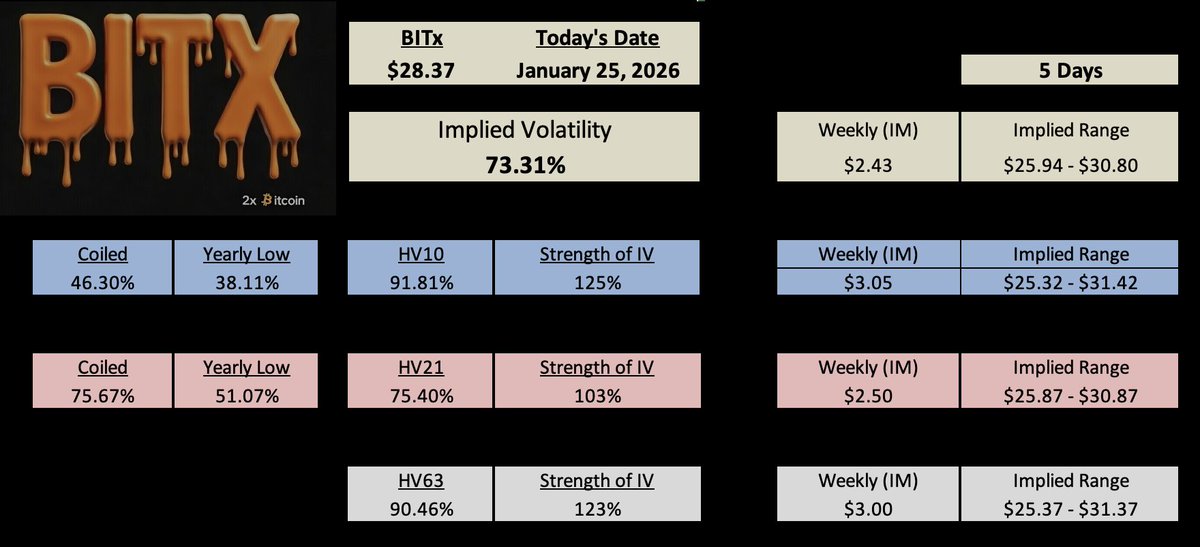

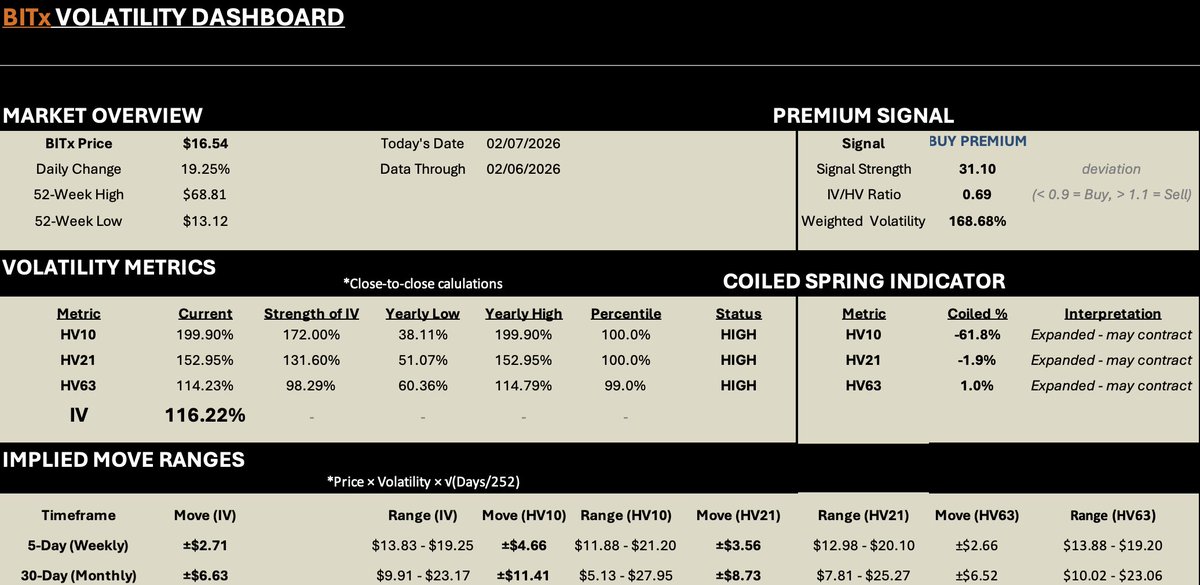

🔸With $BITX (2x leverage) you see the explosion again like with what what we saw in $MSTR from the $BTC liquidation selloff --

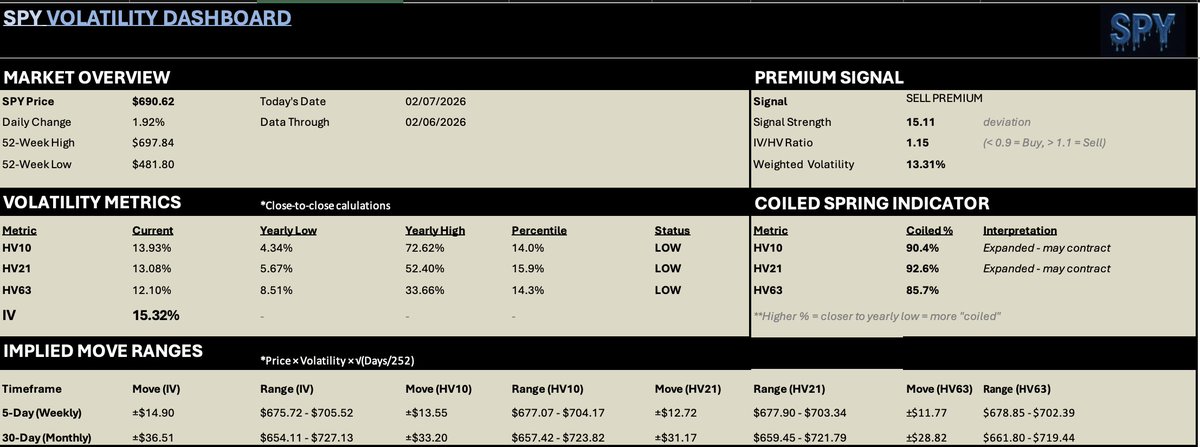

🚦Weighted HV:IV value is 0.68 as what is realized is through the roof compared the what is being implied

🚬🚬🚬 HV10 showing a strength of IV at 172%‼️ https://t.co/BNhqo7Znt6

🚦Weighted HV:IV value is 0.68 as what is realized is through the roof compared the what is being implied

🚬🚬🚬 HV10 showing a strength of IV at 172%‼️ https://t.co/BNhqo7Znt6

1

0

0

47

0

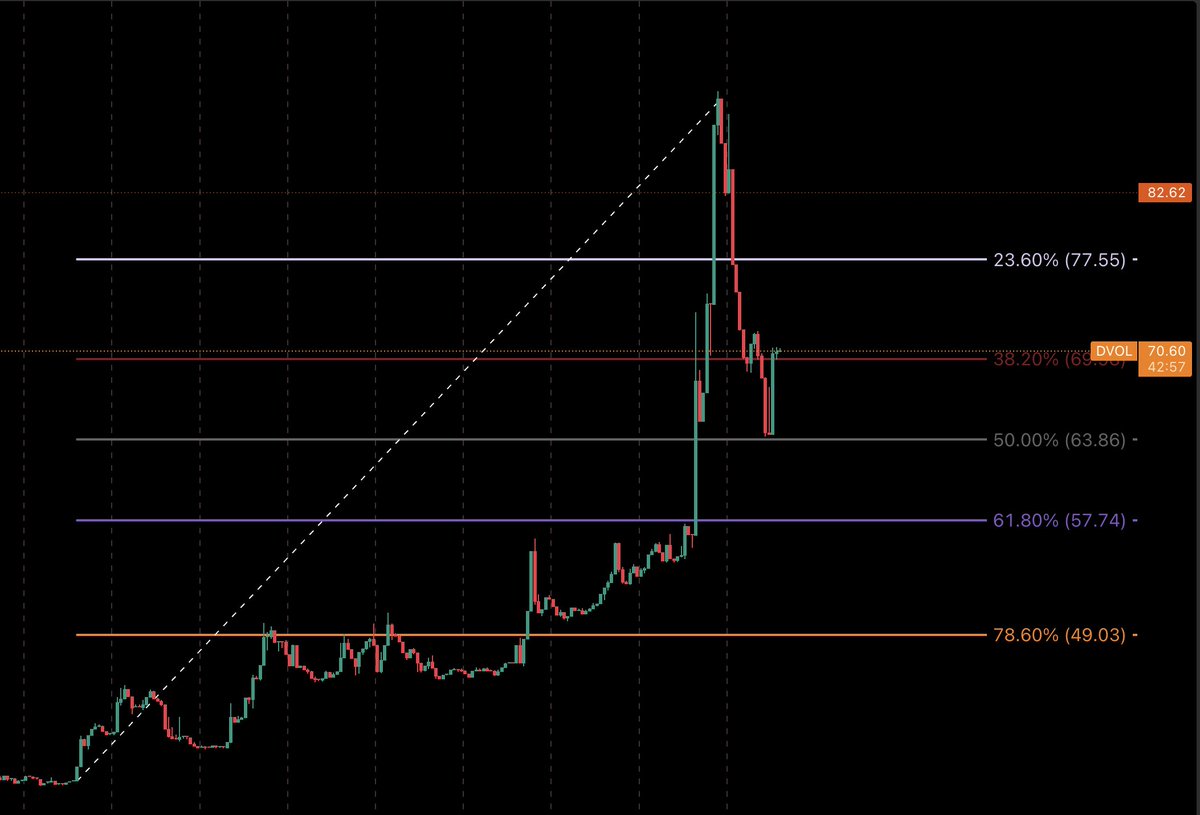

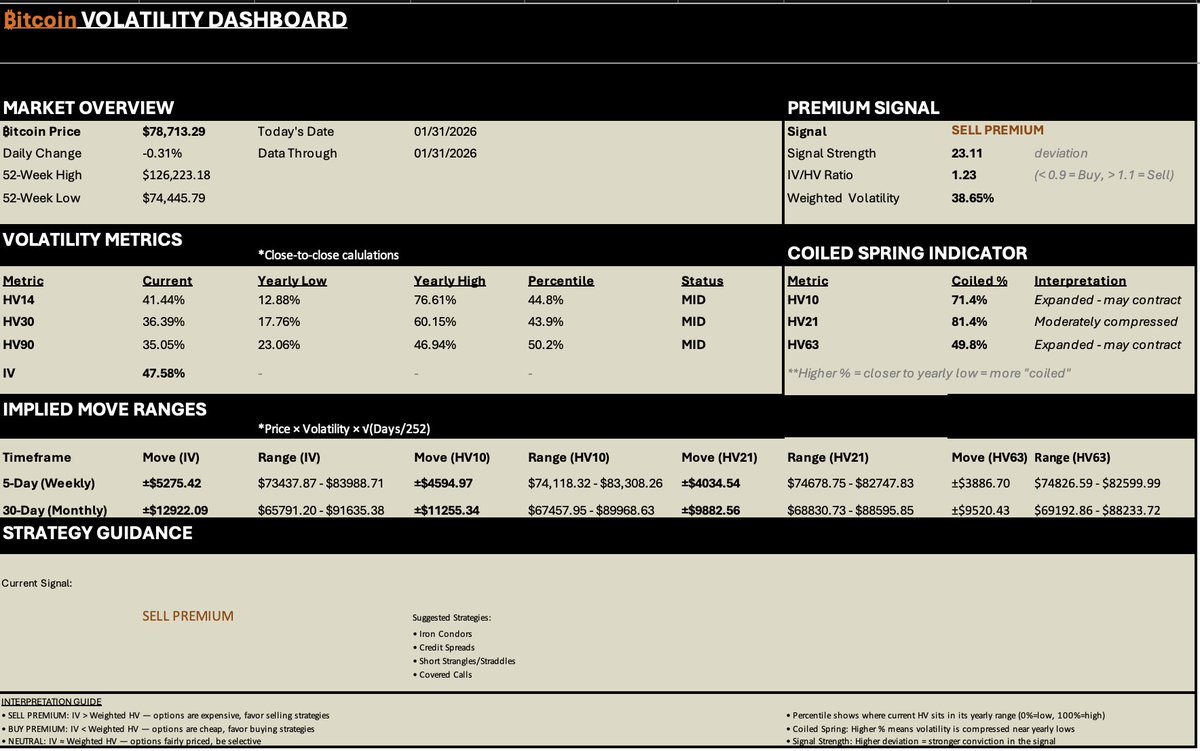

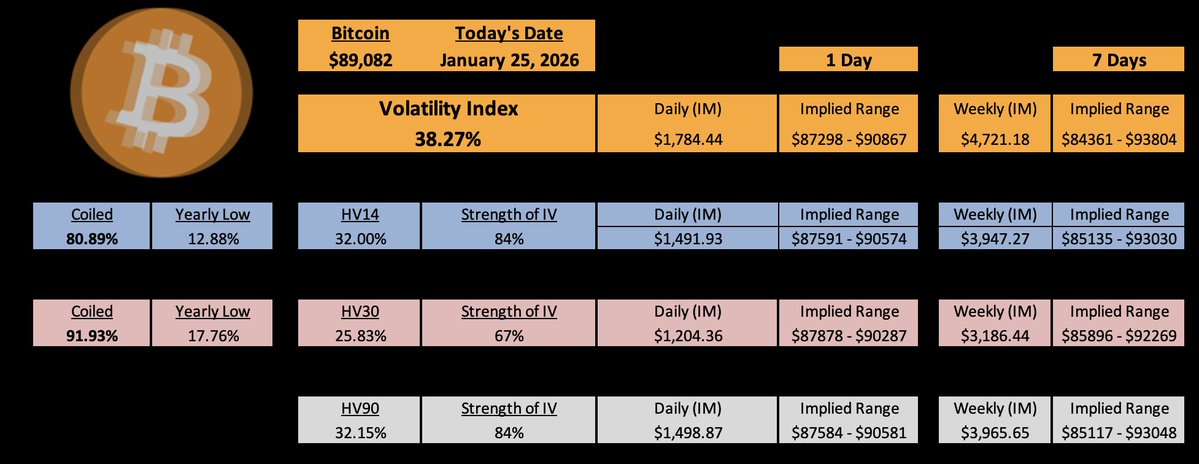

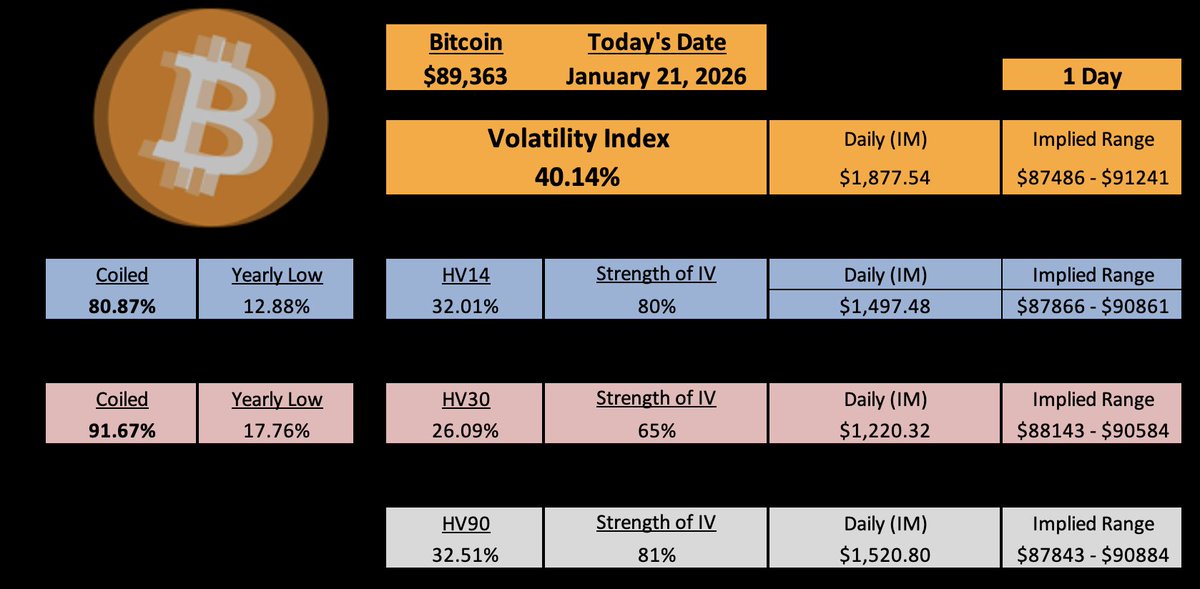

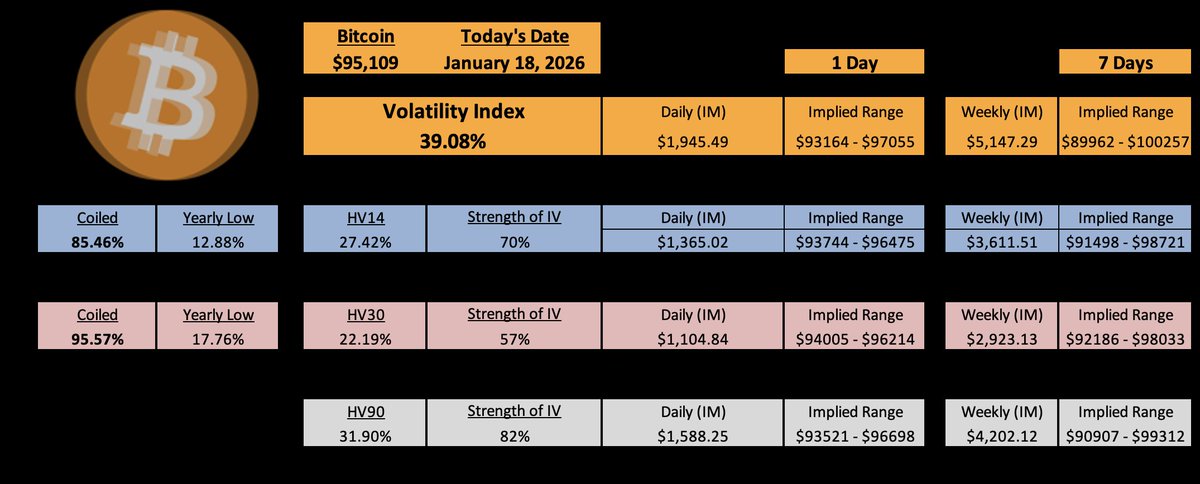

💥 My weekly $BTC volatility snapshot is in💥

🔸This week the $DVOL (39.08%) implies a +/- $1,945.49 move as it drops under 40 for the first time this year

🔸HV14 (27.42%) has slowly been climbing since bottoming around 17% a few weeks ago. All while the volatility index melts https://t.co/8OV8UOJXIr

🔸This week the $DVOL (39.08%) implies a +/- $1,945.49 move as it drops under 40 for the first time this year

🔸HV14 (27.42%) has slowly been climbing since bottoming around 17% a few weeks ago. All while the volatility index melts https://t.co/8OV8UOJXIr

2

0

1

64

0

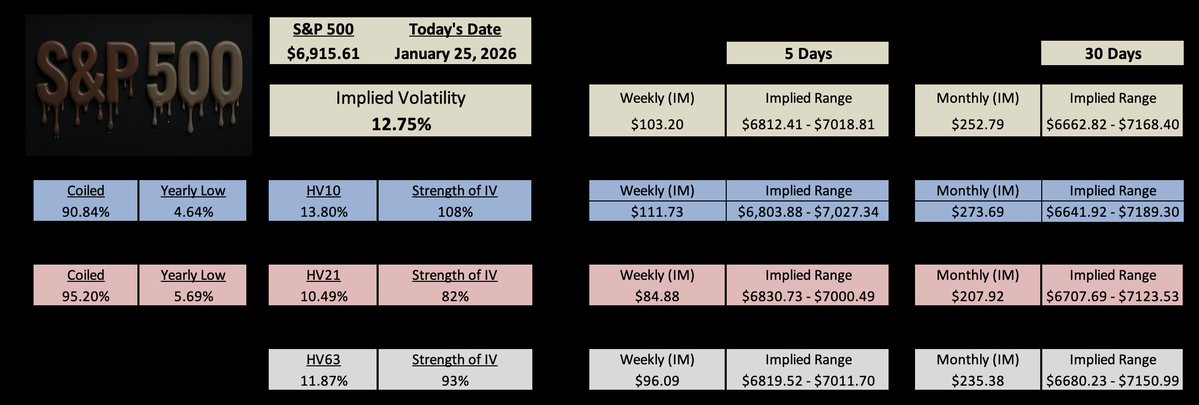

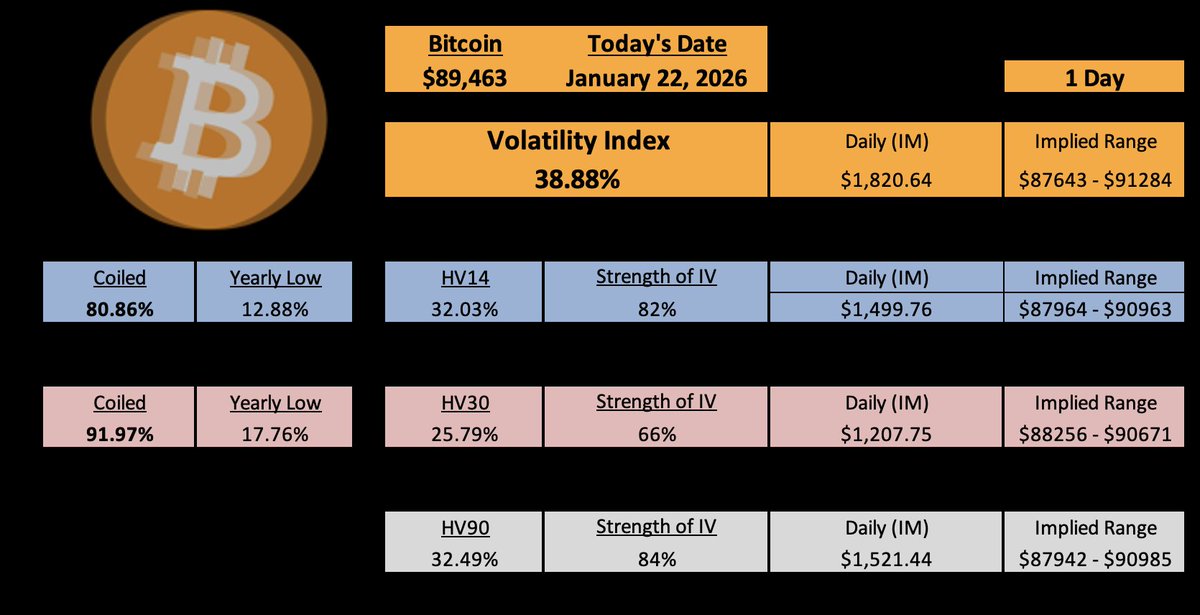

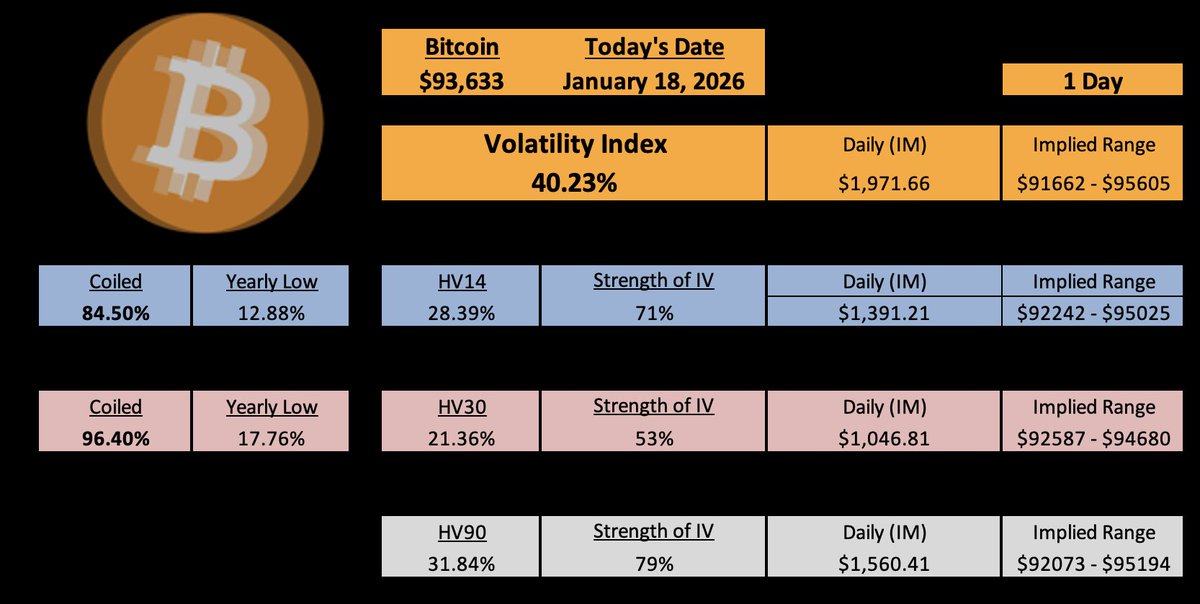

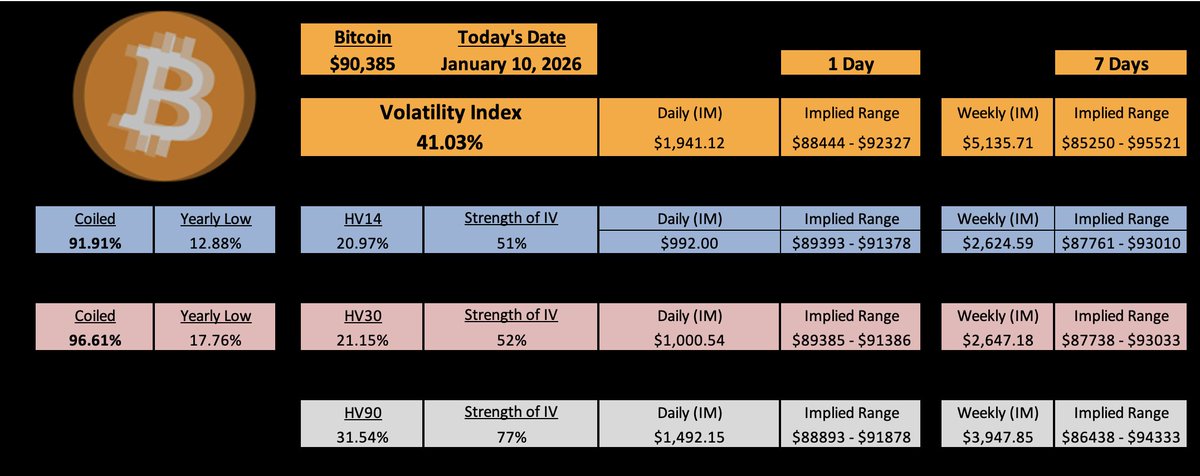

⚡️₿itcoin's short-term historic volatility remains hinged up entering the week with the index implying twice the width in range.

🔸The $DVOL (41.03%) implies a +/- $5,135.71 range for the WEEK

🔸HV14 (20.97%) is showing a 'strength of IV' at 51% and has a trending near-term https://t.co/YUONkZnsSm

🔸The $DVOL (41.03%) implies a +/- $5,135.71 range for the WEEK

🔸HV14 (20.97%) is showing a 'strength of IV' at 51% and has a trending near-term https://t.co/YUONkZnsSm

1

0

1

34

0

13

Total Members

+ 0

24h Growth

+ 1

7d Growth

Date Members Change

Feb 10, 2026 13 +0

Feb 9, 2026 13 +0

Feb 8, 2026 13 +0

Feb 7, 2026 13 +0

Feb 6, 2026 13 +1

Feb 5, 2026 12 +0

Feb 4, 2026 12 +0

Feb 3, 2026 12 +0

Feb 2, 2026 12 +0

Feb 1, 2026 12 +0

Jan 31, 2026 12 +0

Jan 30, 2026 12 +0

Jan 29, 2026 12 +0

Jan 28, 2026 12 —

No reviews yet

Be the first to share your experience!

Share Your Experience

Sign in with X to leave a review and help others discover great communities

Login with XLoading...

Discussion and trade ideas using volatility-adjusted and volatility-based analysis.

Community Rules

Be kind and respectful.

Keep posts on topic.

Never encourage oversizing a position.

Have fun!