Since SAMA introduced digital-only bank licensing in 2020, Saudi Arabia’s banking sector has shifted rapidly toward digital-first models, with faster adoption and rising competition.

Clear leaders have emerged:

• STC Bank – the largest standalone digital bank, serving 3M+ https://t.co/I2DTkLBP1t

Clear leaders have emerged:

• STC Bank – the largest standalone digital bank, serving 3M+ https://t.co/I2DTkLBP1t

0

0

1

91

0

Beltone Venture Capital has invested in Yakeey as part of its US$15M Series A, the largest Series A round in Morocco to date.

Yakeey is building a digital real estate platform that unifies property search, valuation, brokerage, and financing, streamlining how real estate https://t.co/XZH7LAiVCW

Yakeey is building a digital real estate platform that unifies property search, valuation, brokerage, and financing, streamlining how real estate https://t.co/XZH7LAiVCW

0

0

0

29

0

Emirates NBD Capital has received approval from India’s market regulator SEBI to operate as a Category I merchant banker, marking a key expansion of its investment banking footprint in India.

The license allows Emirates NBD Capital to offer the full suite of capital markets https://t.co/8vAIxlIXzE

The license allows Emirates NBD Capital to offer the full suite of capital markets https://t.co/8vAIxlIXzE

0

0

0

40

0

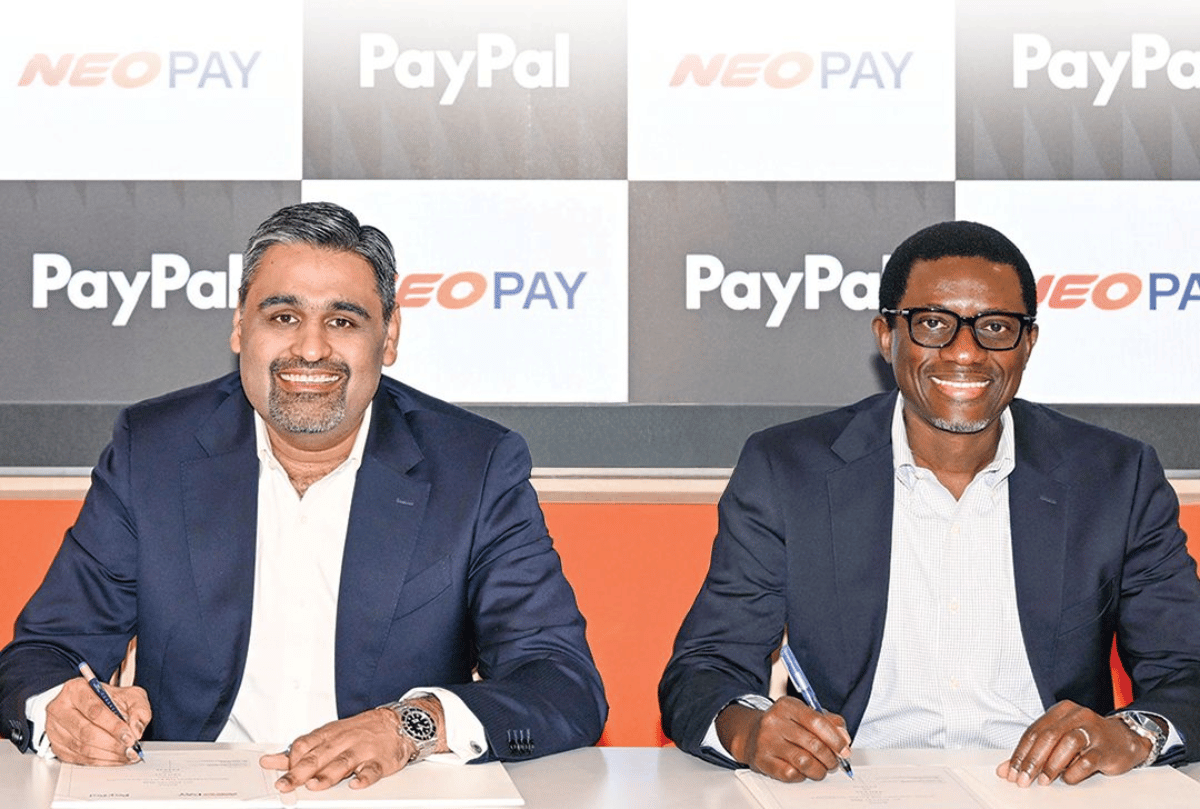

PayPal has partnered with NEOPAY, a UAE-based digital payments provider, to expand PayPal acceptance among merchants across the UAE.

The integration enables merchants to offer PayPal as a secure online payment option and simplifies onboarding through NEOPAY’s acquiring https://t.co/fRSbxHxO7A

The integration enables merchants to offer PayPal as a secure online payment option and simplifies onboarding through NEOPAY’s acquiring https://t.co/fRSbxHxO7A

0

0

0

25

0

Careem Pay has expanded its remittance services, adding mobile wallet transfers to Egypt, USD cash pickup in Lebanon, and improved wallet and cash pickup options for the Philippines.

UAE residents can now send money to 35+ countries, with some transfers completed in minutes. The https://t.co/4xtv3mRKGp

UAE residents can now send money to 35+ countries, with some transfers completed in minutes. The https://t.co/4xtv3mRKGp

0

0

0

41

0

Cairo-based fintech NowPay has entered Saudi Arabia via NowAccess, a JV with Tas’heel.

Backed by a $20minvestment (Tas’heel 75%, NowPay 25%), the venture brings payroll-linked, Shariah-compliant financial wellness solutions to the Kingdom, leveraging Tas’heel’s 310+ locations. https://t.co/tHY6a0wxs0

Backed by a $20minvestment (Tas’heel 75%, NowPay 25%), the venture brings payroll-linked, Shariah-compliant financial wellness solutions to the Kingdom, leveraging Tas’heel’s 310+ locations. https://t.co/tHY6a0wxs0

1

0

1

64

0

Global Money Exchange Oman (GMEC) has launched Global Pay, a new mobile payments app powered by Comviva, supporting Oman’s digital transformation and cashless economy goals.

The app offers instant onboarding, local and international transfers, bill and education payments, https://t.co/PioA3L7LUe

The app offers instant onboarding, local and international transfers, bill and education payments, https://t.co/PioA3L7LUe

0

0

1

38

0

NEO PAY has partnered with Wio Bank PJSC to launch a new PoS lending solution for SME merchants across the UAE.

The model uses real-time sales data to unlock fast, data-driven access to working capital, without lengthy approvals or rigid credit checks. Repayments are linked https://t.co/VHR8d5yV9u

The model uses real-time sales data to unlock fast, data-driven access to working capital, without lengthy approvals or rigid credit checks. Repayments are linked https://t.co/VHR8d5yV9u

0

0

1

31

0

Sultan Haitham bin Tarik has issued a royal decree establishing the International Financial Centre of Oman (IFC Oman), marking a major step in the country’s financial and economic development.

Under Royal Decree No. (8/2026), IFC Oman will operate with full administrative, https://t.co/aMlqYzFER5

Under Royal Decree No. (8/2026), IFC Oman will operate with full administrative, https://t.co/aMlqYzFER5

0

0

1

35

0

Abu Dhabi–based fintech Mal has raised US$230m in seed funding, the largest seed round ever in MENA.

Founded by Abdallah Abu-Sheikh, Mal is building an AI-driven Islamic finance platform targeting Muslim and underbanked communities globally. The round was led by BlueFive Capital https://t.co/nG2Y893A6P

Founded by Abdallah Abu-Sheikh, Mal is building an AI-driven Islamic finance platform targeting Muslim and underbanked communities globally. The round was led by BlueFive Capital https://t.co/nG2Y893A6P

0

0

1

42

0

Al Ahli Bank of Kuwait – Egypt (ABK-Egypt) has partnered with Mastercard to expand consumer, commercial, and digital payment solutions in Egypt.

Mastercard will support ABK-Egypt as a trusted advisor, helping enhance secure, seamless digital payments for customers and businesses https://t.co/2vDLntqmPO

Mastercard will support ABK-Egypt as a trusted advisor, helping enhance secure, seamless digital payments for customers and businesses https://t.co/2vDLntqmPO

0

0

1

49

0

223

Total Members

+ 0

24h Growth

+ 0

7d Growth

Date Members Change

Feb 10, 2026 223 +0

Feb 9, 2026 223 +0

Feb 8, 2026 223 +0

Feb 7, 2026 223 +0

Feb 6, 2026 223 +0

Feb 5, 2026 223 +0

Feb 4, 2026 223 +0

Feb 3, 2026 223 +0

Feb 2, 2026 223 +0

Feb 1, 2026 223 +0

Jan 31, 2026 223 +0

Jan 30, 2026 223 +0

Jan 29, 2026 223 +0

Jan 28, 2026 223 —

No reviews yet

Be the first to share your experience!

Share Your Experience

Sign in with X to leave a review and help others discover great communities

Login with XLoading...

All things MENA Fintech - news, concepts, and insights - brought to you in one place. Stay in the loop and explore the industry in the region.

Community Rules

Be kind and respectful.

Keep posts on topic.

Explore and share.

Refrain from posting Advertisements.